Join Reed Fraasa from Highland Financial Advisors as he demystifies the world of financial advisor fees in this comprehensive video series. Learn about transaction costs, product-related expenses, and advisor fees to make the best decisions for your financial future.

Eating for Immunity - The Nutritional Investment Strategy

Your health is your greatest wealth – a principle that rings true figuratively and literally. Just as prudent financial planning and investing safeguard your long-term financial well-being, a nutritious diet is crucial for fortifying your physical health and averting the debilitating effects of autoimmune diseases.

Tax Lot Identification: It’s Not What You Make, It’s What You Keep

Arnold Schwarzenegger: Bodybuilder, Movie Star, Governor...Financial Planner?

When you think of Arnold Schwarzenegger, visions of his bodybuilding championships, blockbuster movies, and tenure as the governor of California probably come to mind. However, the Austrian-American renaissance man has added another accomplishment to his impressive resume - author. In his book "Be Useful: A Blueprint for Living an Integral Life," Schwarzenegger outlines his philosophy for leading a fulfilling existence by being useful and serving some cause greater than yourself.

Teeing Up Your Financial Future: Unveiling the Hidden Links Between Golf and Financial Planning

Picture this: you stand at the tee box, surveying the undulating terrain ahead with excitement and apprehension. With each club selection and calculated swing, you inch closer to the elusive hole, navigating obstacles and seizing opportunities. Little do you know, every decision you make on the course mirrors the principles of prudent financial management, offering valuable insights into crafting a secure and prosperous future.

Your Politics Don't Belong at The Dinner Table or In Investment Decisions

We've all been there - stuck at the dinner table with the overly political uncle who's had a few beverages and is ready to dive into the latest headlines and hot-button issues. You know the one: every family gathering turns into a political debate, and you're left navigating a minefield of opinions while trying to enjoy your meal. Whether he's passionately defending his views or eagerly challenging yours, it's hard to escape the tension that hangs in the air. If no one comes to mind, perhaps you're that "uncle"?

The Return of Brood XIII: What Cicadas Can Teach Us About Financial Planning

After spending 17 years lying dormant underground, a new generation of Brood XIII cicadas will soon emerge across large swaths of the eastern United States. This phenomenon is one of the most remarkable examples of cyclical events in the natural world.

It's fascinating to think that the last time Brood XIII was about to turn in for its 17-year slumber, Steve Jobs introduced the iPhone to the world for the first time. A year later, a mysterious person named Satoshi Nakamoto wrote a paper describing something he called Bitcoin, which began trading for less than a penny.

Unlocking Financial Freedom: The Power of Organized Financial Documents

In our series on empowering newly Independent Women to achieve financial security, we delve into the often underestimated importance of organizing financial documents. Join Joe Goldy as he uncovers the three significant benefits of maintaining well-organized financial records, offering insights into financial transparency, legal compliance, and emotional closure. Discover how this simple yet powerful practice can advance financial Independence and peace of mind.

Frogs and Inflation…Perfect Together

The story is well-known: if you place a frog into boiling water, it will jump out immediately. But if the frog is put in tepid water that is slowly heated, it will not perceive the impending danger and will eventually be cooked to death. This analogy is a powerful metaphor, cautioning us about the risks posed by gradual changes that go unnoticed—similar to the frog failing to react to the slowly heating water.

This metaphor aptly describes how people often fail to recognize or respond to gradual changes in their environment or circumstances. In financial planning, this concept underscores the importance of regularly monitoring a client's financial status to avoid being metaphorically "cooked."

Dinner with a Time Traveler

It's January 1, 2018, and you just won the lottery for $5,000,000.

You are sitting in our office, discussing your plans for the money, and you decide it's a good idea to invest the proceeds for the long term.

You decide on a portfolio of 25% US Bonds, 60% US Stocks, and 15% International Stocks.

After feeling pretty good about your lottery winnings and the investment decisions you made, you leave our office and treat yourself to a meal.

Monkey Business: Unveiling the Psychology of Financial Decision-Making

The fascinating interplay between human decision-making and financial outcomes has long intrigued behavioral economics and psychology scholars. However, research has expanded this inquiry beyond human subjects, delving into the behavior of our primate cousins, specifically Capuchin monkeys. Situated on an island off the coast of Puerto Rico, researchers conducted an experiment seeking insights into economic behaviors, risk psychology, and the recurrence of financial crises in our societies, shedding light on the parallels between monkey behavior and human decision-making processes.

The Secret Recipe for Success

Navigating Non-Cash Benefits: A Guide for Pharmaceutical Executives

In today's discussion, we embark on the second step of enhancing financial health for pharmaceutical executives: the strategic utilization of non-cash benefits. Led by AnnaMarie Mock, a fee-only certified financial adviser at Highland Financial Advisors, this video aims to shed light on the often underestimated yet impactful facet of compensation packages.

The Myth of CASH

In personal finance, the attraction of cash equivalents for long-term goals has persisted as a seemingly safe and stable investment strategy. Cash equivalents, including savings accounts, money market funds, certificates of deposit (CDs), and Treasury bills, are often viewed as low-risk options that offer liquidity and "preservation of capital." However, the belief that investing primarily in cash equivalents can secure one's financial future in the long term is a myth that should be challenged.

Maximizing Financial Health: A Guide for Dental Practice Owners

In this comprehensive guide, Ed Leach from Highland Financial Advisors extends his expertise to dental practice owners, outlining essential strategies for optimizing financial health. As a seasoned partner and wealth adviser, Ed emphasizes the significance of understanding and evaluating various financial aspects crucial for professional practices and personal wealth management. From analyzing financial reports to assessing net worth and diversifying assets, this guide offers invaluable insights tailored to the unique needs of dental entrepreneurs.

The Surprising Benefits of HSA Accounts for Divorcees

When going through a divorce, there are a million things to think about and plan for - division of assets, child custody arrangements, updating beneficiaries, and more. One aspect often overlooked is what happens to your health insurance and how to manage medical expenses best going forward. This is especially important for divorcees as they will now be managing their own healthcare costs independently rather than on a family plan.

Making the Most of Your Retirement: Prioritizing Healthspan Over Lifespan

As Wealth Advisors with extensive experience guiding high net-worth families through the intricacies of planning for their transition to retirement, we have witnessed firsthand the evolving dynamics of what it means to retire well. Traditionally, the focus has been on ensuring financial security through wealth accumulation, aiming to cover the expanses of one's lifespan. The traditional definition of "Retirement Planning".

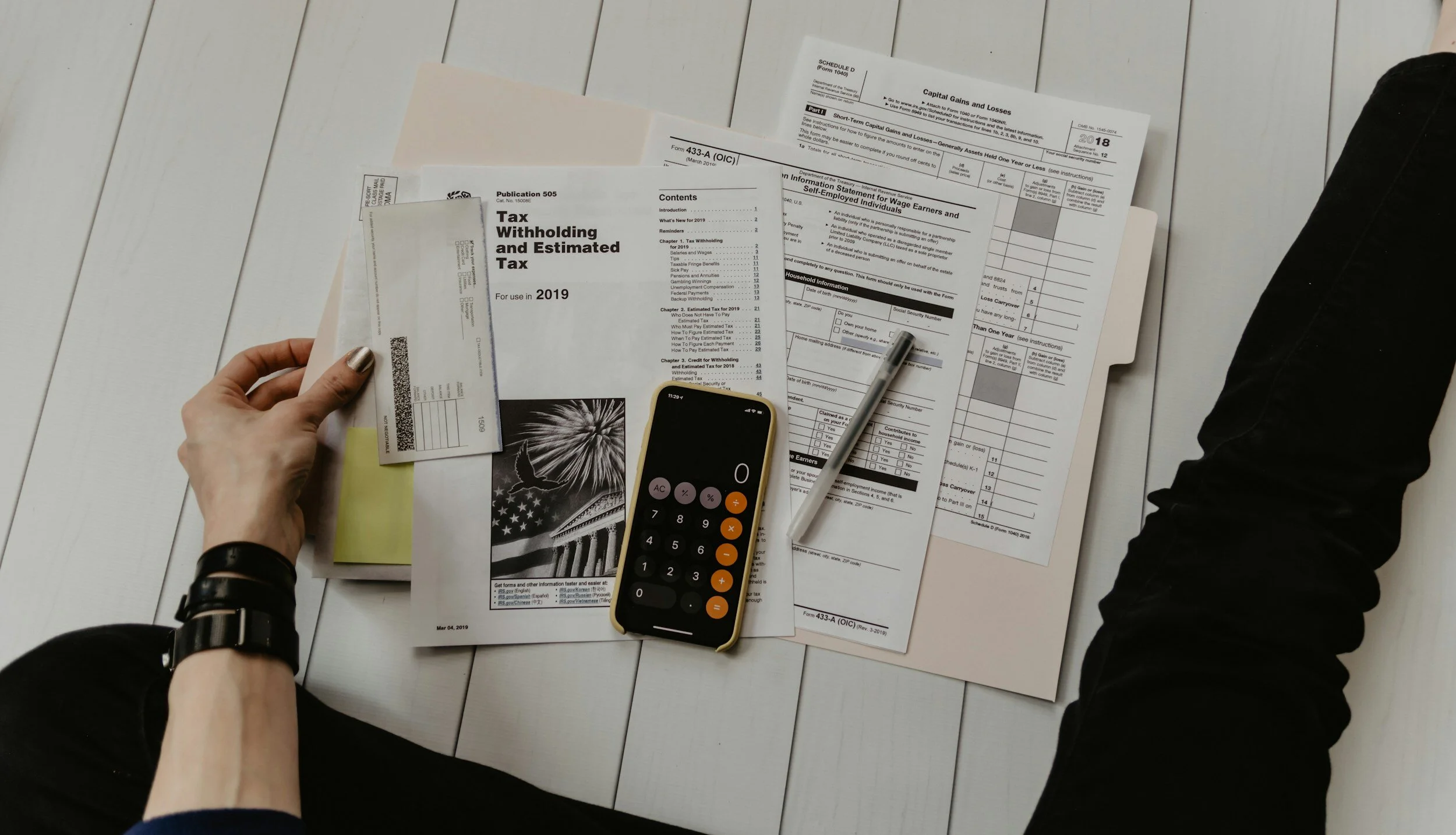

Donating Appreciated Stock and Equity Compensation to Reduce Taxes

As we’re in the throes of tax season, you may be surprised by the potential tax liability you face. In the realm of tax planning, savvy investors are always on the lookout for strategies to minimize their tax burden while maximizing their charitable contributions. One such strategy gaining traction is donating appreciated stock, funds, and equity compensation. By strategically leveraging these assets for charitable giving, individuals can support causes they care about and reduce their tax liability meaningfully.

Demystifying Backdoor Roth IRA Contributions: Answering the Top FAQs

As the April 15th tax filing deadline rapidly approaches, so does the 2023 Roth IRA contribution deadline. Roth IRAs are among the most efficient yet under-utilized retirement saving strategies. By saving after-tax money in a retirement account, individuals can enjoy tax-free investment growth and distributions in retirement.

When Can Investing Resemble Gambling?

I'm reading Daniel Kahneman's book Thinking, Fast and Slow. Kahneman is the 2002 Nobel Prize-winning psychologist and economist known for his work in behavioral economics. One section of the book discusses how investing can resemble gambling when individuals overestimate their ability to predict market movements, a phenomenon deeply connected to Daniel Kahneman's concepts of the "Illusion of Skill" and "Illusion of Validity." These cognitive biases describe the human tendency to overvalue our ability to make accurate predictions or decisions in situations where chance plays a significant role or the information is unreliable.