Subscribe To Our Newsletter

Topics

- 529 Plan

- Bonds

- Business Owners

- Charitable Gifts

- College Planning

- Debt Management

- Dental Practice Owners

- Disability

- Disability Insurance

- Divorce Planning

- Economy

- Estate Planning

- Financial Planning

- Financial Tips

- Goal Planning

- Health Care

- Health Insurance

- Healthcare

- Home Buying

- Investments

- Life Insurance

- Life Planning

- Market Commentary

- Mortgages

- Municipal Bonds

- Net Worth

- Newly Independent Women

- News

- Pet Insurance

- Pharmaceutical Professionals

- Preventing Scams

- Private Investments

- Real Estate

- Retirement Planning

- Savings

- Stock Market

- Stock Options

- Stocks

- Student Loans

- Taxes

- The Person is the Plan®

- Travel

In the Learning Center, we discuss the issues important to your financial well-being. We think these pieces exemplify our thought process at HIGHLAND Financial Advisors—if our approach appeals to you, please contact us to see how we can apply this approach to your life.

As we reflect on the recent market developments, it's crucial to maintain realistic expectations during this volatile period. While the stock market opened positively last Friday, the situation remains fluid, and conditions can quickly shift.

Tackling debt can feel like climbing a mountain, but with the right strategy, you can reach the debt-free summit faster than you might think. Whether dealing with credit cards, student loans, or other forms of debt, implementing a structured approach can save you thousands in interest and free you from financial burden sooner.

As fiduciary financial advisors, we strive to remain objective and apolitical in our advice. Political bias can lead investors to make poor decisions, and our role is to offer clear guidance grounded in facts. With that in mind, we offer a measured explanation of the market’s response to President Trump’s newly implemented tariffs.

As a financial advisor, one of my most important recommendations to my clients is to review and update their beneficiary designations regularly. Life changes and your estate plan should evolve to reflect your current wishes and circumstances. Failing to update beneficiaries on retirement accounts, insurance policies, and wills can lead to unintended consequences, potentially leaving your loved ones in a difficult situation.

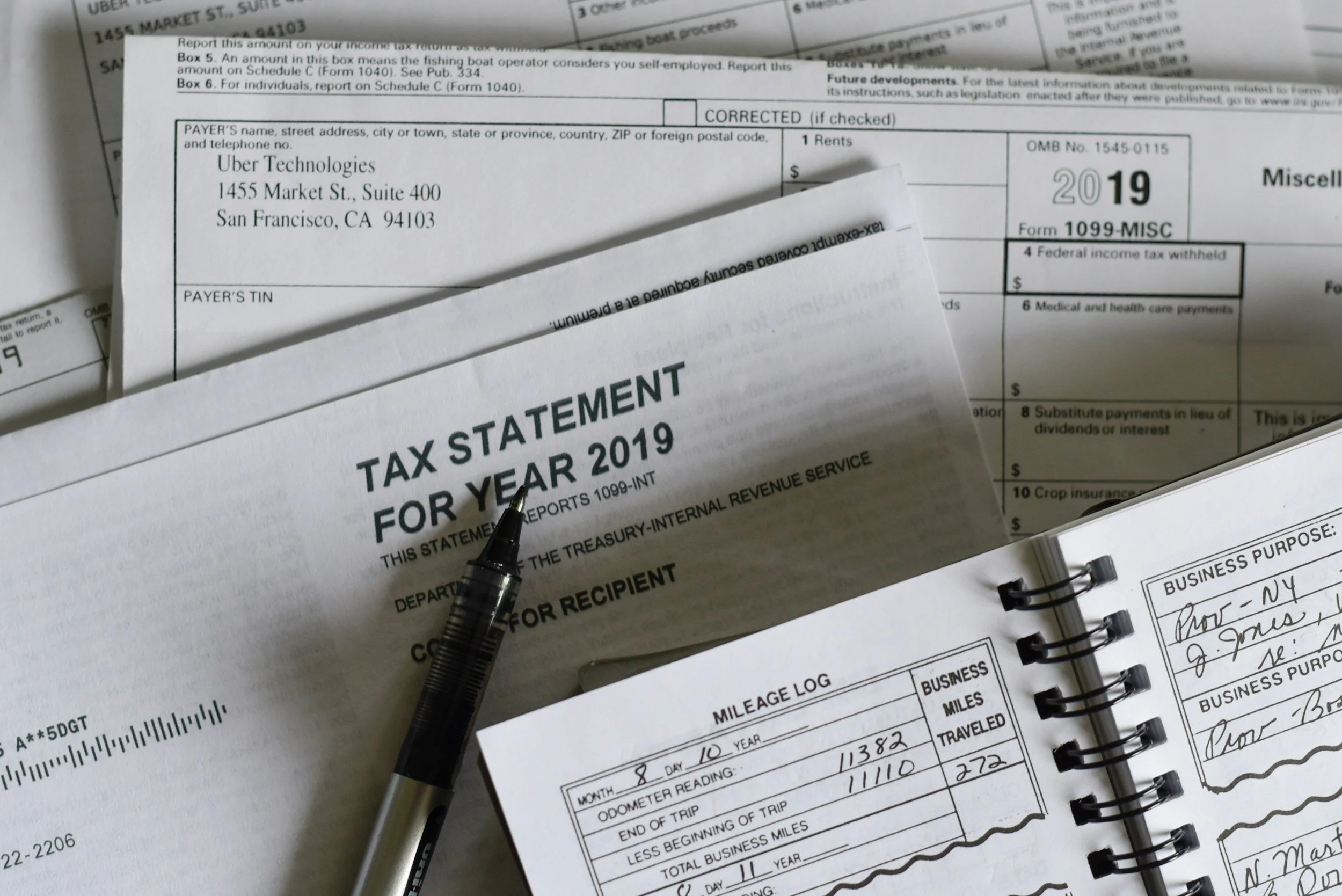

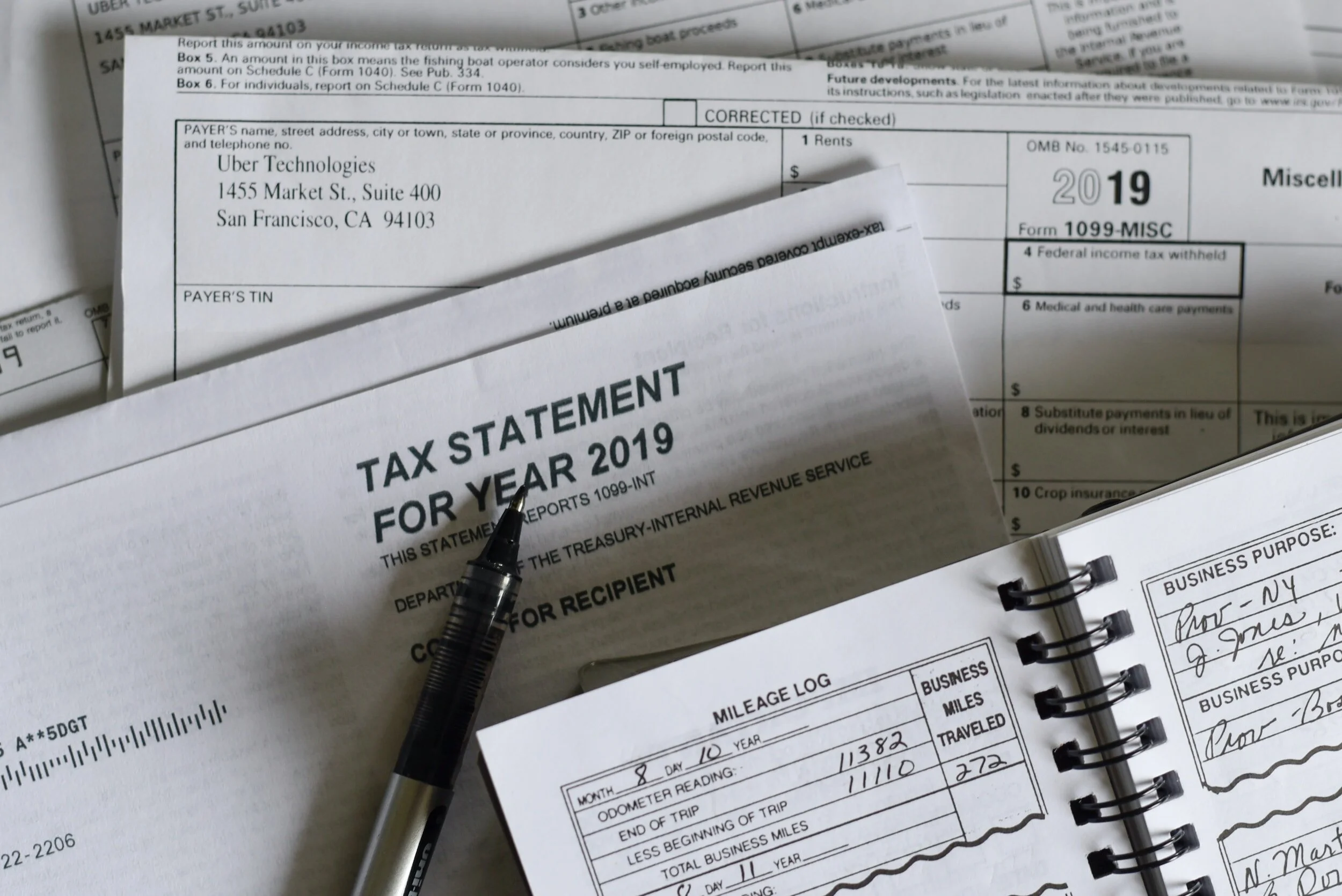

Being self-employed comes with plenty of perks—flexibility, control over your income, and the ability to shape your career. But it also comes with responsibilities, including staying on top of taxes. One way to reduce your tax burden is by taking advantage of every deduction available to you.

As you prepare for the 2024 tax filing season and look ahead to 2025 tax planning, reviewing specific tax considerations that could impact your return is essential. Below are key areas to focus on to maximize deductions, minimize liabilities, and optimize financial strategies.

Tariffs have long been a tool used by governments to influence international trade and protect domestic industries. While they might seem like a topic best left to economists and policymakers, tariffs can have real-world economic and market implications. Understanding how tariffs work and how they might affect our financial plans is essential for making informed financial decisions.

As tax season approaches and winter gives way to spring, March presents the perfect opportunity for a financial refresh. As you might tackle spring cleaning in your home, dedicating time to tidying up your financial house can yield tremendous benefits.

As tax season comes into full swing, many financial institutions have already begun sending out various tax forms to investors nationwide. For most, this is a stressful time due to the seemingly endless amount of paperwork to keep on top of. It can also be extra burdensome for investors with several moving pieces in their financial lives.

Your FICO score is critical in determining your financial opportunities, from securing a mortgage to getting the best interest rates on loans. A high FICO score can save you thousands of dollars over your lifetime, while a low score can limit your options and cost you more in interest. In this guide, we'll explain a FICO score, why it matters, and how to maintain a strong credit profile.

The conventional wisdom in personal finance often suggests maximizing your 401(k) contributions each year. While this advice can be sound for many people, financial planning isn't one-size-fits-all. Just like you wouldn't follow your neighbor's exact grocery list or copy their summer vacation plans (unless it was an epic trip), your retirement strategy needs to be tailored to your specific situation.

Tax season is approaching, and this time of year can feel overwhelming for many individuals and business owners. The key to a stress-free tax filing experience is organization. By proactively gathering and structuring your financial documents, you can maximize deductions, avoid errors, and ensure a smoother process when working with your tax preparer or filing independently.

Ed Leach, Partner and Wealth Advisor, is joining the Board of Directors for Passaic County Habitat for Humanity starting this January. By stepping into this volunteer leadership role, Ed will contribute his personal time and energy to advancing Passaic County Habitat’s mission of building homes, communities, and hope.

As a dental practice owner, securing your business's future is just as crucial as providing quality patient care. Effective business succession planning ensures your practice continues to thrive, even in the face of unforeseen events.

As we embark on a new year, there's no better time to take control of your financial future by thoroughly reviewing your cash flow. If having a vision and establishing goals is the touchstone for a financial plan, this essential financial practice sets the foundation for achieving your goals and ensuring long-term financial stability.

The most successful financial strategies aren't just about numbers – they're deeply rooted in personal values and long-term life objectives. When financial goals align with what truly matters to you, you're more likely to stay committed and find fulfillment in your financial journey.

As 2024 comes to a close, many investors find themselves reflecting on the stock market's performance over the past two years, wondering if history will repeat itself in 2025. It's a natural question highlighting the interplay of emotions, biases, and decision-making—the core of behavioral finance.

The holiday season will soon pass, and for many, the joy of gift-giving has been overshadowed by a mounting credit card balance. As bills start rolling in, the temptation to explore a credit card balance transfer becomes increasingly attractive. But is this financial strategy a lifeline or a potential trap?

As the year-end holidays come into full swing, it is essential to remember to be mindful about holiday spending. With the savings and deals that pop up now and throughout the year, it is easy to get carried away. However, one must consider that impulsive spending may lead to post-purchase regrets.

HIGHLAND Financial Advisors is excited to share that Edward Leach, CFP®, MBA, has earned the Certified Exit Planning Advisor (CEPA) designation through the Exit Planning Institute (EPI). This education and experience strengthen HIGHLAND's ability to provide personalized wealth management to business owners as they navigate the complex planning process for their businesses' eventual transition.

Choosing the right financial advisor is one of the most important decisions you'll make for your financial future. But with so many types of advisors and compensation structures, it can be challenging to know where to start. In this video, Reed Fraasa, a Certified Financial Planner® and founder of Highland Financial Advisors, breaks down the key differences between "fee-only" and "fee-based" financial advisors.

As 2025 approaches, significant updates to employer-sponsored retirement plans are set to impact how employees can save for retirement. These changes, including increased contribution limits and enhanced catch-up provisions, offer new opportunities to maximize tax-advantaged savings.

When building a financial plan, many people focus on investments, retirement accounts, and life insurance. However, one crucial component is often overlooked: disability insurance. Your ability to earn an income is your most significant financial asset. Protecting it is as vital as safeguarding your home, car, or retirement savings.

Donating appreciated stock and equity compensation is a powerful way for savvy investors, pharmaceutical executives, and high-income earners to reduce tax liability while supporting meaningful causes. By leveraging appreciated assets like stocks or restricted stock units (RSUs), donors can avoid capital gains taxes, diversify their portfolios, and preserve liquidity for other financial needs.

Mediation offers couples a dignified, collaborative path forward when life circumstances require critical legal decisions about their future. As a trained family law mediator, Zoe Cassotis guides New Jersey families through productive conversations that lead to thoughtful, mutually beneficial solutions. Her confidential mediation approach helps people maintain control of their decisions while saving time and money, creating positive outcomes that respect both parties' needs and values.

The current interest rate environment has driven many to explore high-yield money market accounts and certificates of deposit (CDs) as viable investment vehicles. With interest rates on these instruments at levels unseen in over a decade, it's easy to understand the appeal. However, there is an irony in using these vehicles as long-term investment strategies, especially when compared to the potential tax advantages the stock market offers.

Year-end review season can be an excellent opportunity for those in the workforce to receive feedback on your job performance and push your career forward. Sometimes, year-end conversations can create anxiety, especially if you plan to negotiate a promotion or pay raise and aren’t quite sure what direction the conversation will take.

During my first year in college, I read my first investment book, "The Intelligent Investor" by Benjamin Graham, widely regarded as one of the greatest stock traders ever. Filled with excitement, I took copious notes, convinced I had stumbled upon the secret to success in the stock market. With this new knowledge, I eagerly deposited $600 into a trading account and made my first trade, purchasing ten shares of Columbia Sportswear Company stock ($COLM) at $56.80 per share.

As the end of the year approaches, it’s time for one of the most critical financial planning opportunities for employees: open enrollment. Whether you’re re-evaluating your benefits or making selections for the first time, open enrollment is a golden opportunity to make choices that align with your financial goals and needs.

Anyone who has gone through a divorce knows how emotionally challenging and financially complex it can be. While attorneys handle the legal aspects, a Certified Divorce Financial Analyst® focuses specifically on the financial implications of divorce. This specialized designation equips professionals with the expertise to guide clients through the intricate financial aspects of divorce proceedings, ensuring better outcomes for their financial future.

You’ve worked hard to build a stable life for your loved ones, but are you taking the necessary steps to protect their financial future? Life insurance is a crucial tool that provides peace of mind, ensuring that your family won’t be burdened with financial worries if something happens to you. It’s an essential part of any comprehensive financial plan, whether it’s to support your family’s needs or to preserve the stability of a business.

Deciding whether to keep the marital home after a divorce is one of the most significant financial and emotional decisions newly independent women face. While it may seem logical to hold onto the house, there are numerous factors to consider—financial feasibility, practical living conditions, and the emotional impact on you and your children.

As a dental practice owner, planning for your retirement is essential—not just for your future but for your practice's long-term success and your team's well-being. Choosing the right retirement plan can be overwhelming, with options like SEP IRA, Simple IRA, 401(k), and Defined Benefit Cash Balance Plans. Each of these plans offers unique benefits and challenges, so it's crucial to understand which option best aligns with your financial goals and practice needs.

Anna Marie Mock, a fee-only certified financial planner at Highland Financial Advisors, discusses the dynamic interplay between art and science in financial planning. Drawing inspiration from Leonardo da Vinci's philosophy that "everything connects to everything else," she emphasizes that financial planning is an art involving subjective goal-setting and a science-driven by objective analysis tools. In this video, Anna explains how the scientific method can be applied to financial planning, using equity compensation as a concrete example.

What are your thoughts, feelings, and beliefs about money? What about your partner, and do they differ from your own? Sometimes, the conflict we experience around money in our personal lives can be attributed to incongruent money scripts with those with whom we share finances. Let’s dive into the term money script and how understanding it can help us achieve our financial goals.

As I approach my thirties, I've noticed that my body doesn't bounce back from workouts as quickly as in my high school and college years. The days of waking up fresh after an intense workout without a second thought are behind me. Now, I realize the importance of adding mobility work and stretching to my weekly routine. Lower back pain and tightness have become recurring issues, mainly due to sitting more throughout the day and most likely lifting too heavy without perfect form.

Discover the hidden financial dangers many newly independent women face after divorce. In this video, Certified Financial Planner™ Joe Goldy shares three vital strategies to prevent overspending, manage your finances, and secure your future. From creating a "fun money" account to working with a CFP®, learn how to navigate your new financial landscape confidently. Don't miss out on these expert tips—subscribe for more insights!

In this video, AnnaMarie Mock, a fee-only Certified Financial Planner at Highland Financial Advisors, walks you through the third step in maximizing the financial health of pharmaceutical executives: defining a purpose for your human and investment capital. Drawing from her personal experiences, AnnaMarie explains the importance of setting clear, specific, and attainable financial goals. She also outlines a step-by-step framework—Identify, Quantify, and Solidify—to help you create a purpose for your assets and achieve long-term financial freedom.

The recent settlement between the National Association of Realtors (NAR) and various plaintiffs marks a significant turning point in the real estate industry. This agreement, which resolves allegations of anti-competitive practices, took effect on August 17th and could substantially change how homes are bought and sold across the United States.

As a financial advisor, I often hear clients express concern over the Federal Reserve's interest rate decisions and how these might impact their long-term investments. While it's natural to be attentive to such economic indicators, focusing solely on interest rate changes when planning your long-term investment strategy can be a misstep. Here’s why it’s important to maintain a broader perspective.

In today's video, Certified Financial Planner™ Ed Leach delves into a crucial yet often overlooked aspect of estate planning for dental practice owners. For both your personal and business life, ensuring the correct legal documents are in place with updated beneficiaries is essential. This video will provide a quick overview of all the estate planning documents and their purpose for your financial health.

Many people find themselves at a career crossroads in the aftermath of divorce. As a career coach specializing in helping women navigate this transition at her firm, Next Stage Career Success, Shauna Licciardi has seen the transformative power of rediscovering one's purpose. From her experience as a human resources director and career coach, Shauna explains the importance of finding your "why" when charting your next career move post-divorce.

Updating estate documents is crucial because it ensures that your wishes are accurately reflected and legally honored as your life circumstances change. Imagine the birth of a new child, a marriage, a divorce, or the windfall of significant assets. These events can dramatically alter your intentions regarding who should inherit your belongings and how it's managed.

At Highland Financial Advisors, we believe that the foundation of a successful financial plan starts with clear and meaningful goal setting. Our latest video emphasizes why identifying your financial goals is crucial whether you're working with an adviser or managing your finances independently. Through our unique Discovery process, we guide you to connect deeply with your aspirations, ensuring that your financial plan aligns with the life you envision. Join us as we uncover the powerful questions that can transform your financial journey and help you build a future free from regrets.

As a business owner, planning for retirement is crucial not only for securing your future but also for attracting and retaining top talent. With various retirement plan options available, it can be challenging to determine which one best suits your needs and the needs of your employees. In this article, we'll explore four popular retirement plans, SEP IRA, SIMPLE IRA, 401(k), and Defined Benefit Cash Balance Plans, to help you make an informed decision.

Welcome to Highland Financial Advisor's comprehensive video series, designed to guide you through the crucial steps of interviewing and starting a relationship with a fiduciary financial advisor. Whether you're new to financial planning or looking to optimize your current strategy, our clearly defined process and expert advice will help you make informed decisions. In this series, we'll cover everything from understanding fees and value to setting financial goals and creating a personalized wealth management plan. Subscribe now to stay updated and take control of your financial future with confidence.

A 529 plan is a powerful tool designed to help families save for future education expenses. The primary allure of a 529 plan lies in its tax benefits—some states allow state-tax deductions or credits on account contributions, and the investments in the account grow tax-free. Withdrawals from 529 plans are tax-free if used for qualified educational expenses, including tuition, room and board, books and supplies, private elementary and secondary school education, and student loan repayments.

In today's video, Certified Financial Planner™ Ed Leach delves into a crucial yet often overlooked aspect of financial planning for dental practice owners: cash reserves. Understanding and managing your cash reserves can significantly impact the stability and growth of your practice and your financial security. This video will answer critical questions about how much you should have in your practice and personal savings accounts, what types of accounts you should use, and how to choose the right banking relationship.

Going through a divorce can be an incredibly stressful and emotionally draining experience. In addition to dealing with the end of a marriage, there are practical and financial implications to navigate. One potential pitfall many divorcees find themselves in is overspending to cope with the changes and upheaval in their lives.

Equity compensation is a powerful tool for pharmaceutical executives to enhance their financial health and secure a stake in their company's long-term growth. As a Certified Financial Planner™ at Highland Financial Advisors, AnnaMarie Mock delves into the intricacies of equity compensation, providing valuable insights and strategies. In this video, we explore the various components of equity compensation, including stock options and grants, to help you make informed decisions and optimize your financial plan.

At Highland Financial Advisors, we're proud to introduce Joey Casolaro, one of our talented Associate Wealth Advisors based in Wayne, NJ. Recently, Joey sat down with Caleb Brown on the New Planner Podcast for an insightful discussion about his journey into the financial planning profession and the career path that led him to our firm.

In this installment of our video series on financial planning for newly independent women, we delve into updating beneficiaries across key financial documents and accounts. Whether you are navigating the aftermath of a divorce or coping with the recent loss of a spouse, it is essential to review and revise your estate documents, life insurance policies, and investment accounts to reflect your new circumstances. Additionally, we'll explore health insurance options that are available to you during this transition. These steps ensure your financial future is secure and your assets are distributed according to your wishes.

In my 40+ years as a CPA, I’ve had many clients place having a will or updating an older will take a back seat to all other financial matters.

In the fast-paced world of dental practice ownership, making informed financial decisions is crucial for long-term success and stability. In this informative video series, a financial expert, Ed Leach, guides dental practice owners through the complexities of managing their finances. The series introduces a straightforward framework designed to help owners make smart money decisions, whether just starting or looking to optimize their financial strategies.

Rummaging around your stuffed filing cabinet, you come across a stock certificate. A glint of excitement enters as you think about the potential value of this forgotten relic. It is not uncommon to stumble upon an old stock certificate in its physical form. There are steps to take to research if the old stock certificate is worthless or if it is a lottery ticket.

Join Reed Fraasa from Highland Financial Advisors as he demystifies the world of financial advisor fees in this comprehensive video series. Learn about transaction costs, product-related expenses, and advisor fees to make the best decisions for your financial future.

Your health is your greatest wealth – a principle that rings true figuratively and literally. Just as prudent financial planning and investing safeguard your long-term financial well-being, a nutritious diet is crucial for fortifying your physical health and averting the debilitating effects of autoimmune diseases.

At HIGHLAND Financial Advisors, tax efficiency is a cornerstone of our investment management strategy. After all, it is not what you make but what you keep. One of the key strategies we use to achieve this is tax lot identification in our trading procedures.

When you think of Arnold Schwarzenegger, visions of his bodybuilding championships, blockbuster movies, and tenure as the governor of California probably come to mind. However, the Austrian-American renaissance man has added another accomplishment to his impressive resume - author. In his book "Be Useful: A Blueprint for Living an Integral Life," Schwarzenegger outlines his philosophy for leading a fulfilling existence by being useful and serving some cause greater than yourself.

Picture this: you stand at the tee box, surveying the undulating terrain ahead with excitement and apprehension. With each club selection and calculated swing, you inch closer to the elusive hole, navigating obstacles and seizing opportunities. Little do you know, every decision you make on the course mirrors the principles of prudent financial management, offering valuable insights into crafting a secure and prosperous future.

We've all been there - stuck at the dinner table with the overly political uncle who's had a few beverages and is ready to dive into the latest headlines and hot-button issues. You know the one: every family gathering turns into a political debate, and you're left navigating a minefield of opinions while trying to enjoy your meal. Whether he's passionately defending his views or eagerly challenging yours, it's hard to escape the tension that hangs in the air. If no one comes to mind, perhaps you're that "uncle"?

After spending 17 years lying dormant underground, a new generation of Brood XIII cicadas will soon emerge across large swaths of the eastern United States. This phenomenon is one of the most remarkable examples of cyclical events in the natural world.

It's fascinating to think that the last time Brood XIII was about to turn in for its 17-year slumber, Steve Jobs introduced the iPhone to the world for the first time. A year later, a mysterious person named Satoshi Nakamoto wrote a paper describing something he called Bitcoin, which began trading for less than a penny.

In our series on empowering newly Independent Women to achieve financial security, we delve into the often underestimated importance of organizing financial documents. Join Joe Goldy as he uncovers the three significant benefits of maintaining well-organized financial records, offering insights into financial transparency, legal compliance, and emotional closure. Discover how this simple yet powerful practice can advance financial Independence and peace of mind.

The story is well-known: if you place a frog into boiling water, it will jump out immediately. But if the frog is put in tepid water that is slowly heated, it will not perceive the impending danger and will eventually be cooked to death. This analogy is a powerful metaphor, cautioning us about the risks posed by gradual changes that go unnoticed—similar to the frog failing to react to the slowly heating water.

This metaphor aptly describes how people often fail to recognize or respond to gradual changes in their environment or circumstances. In financial planning, this concept underscores the importance of regularly monitoring a client's financial status to avoid being metaphorically "cooked."

It's January 1, 2018, and you just won the lottery for $5,000,000.

You are sitting in our office, discussing your plans for the money, and you decide it's a good idea to invest the proceeds for the long term.

You decide on a portfolio of 25% US Bonds, 60% US Stocks, and 15% International Stocks.

After feeling pretty good about your lottery winnings and the investment decisions you made, you leave our office and treat yourself to a meal.

The fascinating interplay between human decision-making and financial outcomes has long intrigued behavioral economics and psychology scholars. However, research has expanded this inquiry beyond human subjects, delving into the behavior of our primate cousins, specifically Capuchin monkeys. Situated on an island off the coast of Puerto Rico, researchers conducted an experiment seeking insights into economic behaviors, risk psychology, and the recurrence of financial crises in our societies, shedding light on the parallels between monkey behavior and human decision-making processes.

Each of us has two powerful assets we can cultivate throughout our lives: human and investment capital. These twin engines of wealth can propel us toward greater prosperity and financial independence.

In today's discussion, we embark on the second step of enhancing financial health for pharmaceutical executives: the strategic utilization of non-cash benefits. Led by AnnaMarie Mock, a fee-only certified financial adviser at Highland Financial Advisors, this video aims to shed light on the often underestimated yet impactful facet of compensation packages.

In personal finance, the attraction of cash equivalents for long-term goals has persisted as a seemingly safe and stable investment strategy. Cash equivalents, including savings accounts, money market funds, certificates of deposit (CDs), and Treasury bills, are often viewed as low-risk options that offer liquidity and "preservation of capital." However, the belief that investing primarily in cash equivalents can secure one's financial future in the long term is a myth that should be challenged.

In this comprehensive guide, Ed Leach from Highland Financial Advisors extends his expertise to dental practice owners, outlining essential strategies for optimizing financial health. As a seasoned partner and wealth adviser, Ed emphasizes the significance of understanding and evaluating various financial aspects crucial for professional practices and personal wealth management. From analyzing financial reports to assessing net worth and diversifying assets, this guide offers invaluable insights tailored to the unique needs of dental entrepreneurs.

When going through a divorce, there are a million things to think about and plan for - division of assets, child custody arrangements, updating beneficiaries, and more. One aspect often overlooked is what happens to your health insurance and how to manage medical expenses best going forward. This is especially important for divorcees as they will now be managing their own healthcare costs independently rather than on a family plan.

As Wealth Advisors with extensive experience guiding high net-worth families through the intricacies of planning for their transition to retirement, we have witnessed firsthand the evolving dynamics of what it means to retire well. Traditionally, the focus has been on ensuring financial security through wealth accumulation, aiming to cover the expanses of one's lifespan. The traditional definition of "Retirement Planning".

As we’re in the throes of tax season, you may be surprised by the potential tax liability you face. In the realm of tax planning, savvy investors are always on the lookout for strategies to minimize their tax burden while maximizing their charitable contributions. One such strategy gaining traction is donating appreciated stock, funds, and equity compensation. By strategically leveraging these assets for charitable giving, individuals can support causes they care about and reduce their tax liability meaningfully.

As the April 15th tax filing deadline rapidly approaches, so does the 2023 Roth IRA contribution deadline. Roth IRAs are among the most efficient yet under-utilized retirement saving strategies. By saving after-tax money in a retirement account, individuals can enjoy tax-free investment growth and distributions in retirement.

I'm reading Daniel Kahneman's book Thinking, Fast and Slow. Kahneman is the 2002 Nobel Prize-winning psychologist and economist known for his work in behavioral economics. One section of the book discusses how investing can resemble gambling when individuals overestimate their ability to predict market movements, a phenomenon deeply connected to Daniel Kahneman's concepts of the "Illusion of Skill" and "Illusion of Validity." These cognitive biases describe the human tendency to overvalue our ability to make accurate predictions or decisions in situations where chance plays a significant role or the information is unreliable.

Sarah, a savvy pharmaceutical executive, has accumulated Non-Qualified Stock Options (NQSOs) and Restricted Stock Units (RSUs) as part of her compensation package. Sarah had always been meticulous with her finances and records of her stock option grants, exercise dates, and the fair market values at the time of exercise. As her stock compensation vested over the years, she knew proper tax reporting was crucial to avoid any IRS headaches.

Buy low, sell high. This four-word phrase is the only thing you need to know to invest successfully. Why, then, is something so simple as buying low and selling high such a difficult skill to be successful at? The answer is that we all have emotions that drive our investment decisions.

In this video, Joe Goldy from Highland Financial Advisors discusses the significance of cash flow as a critical tool in financial planning, emphasizing its universal application for all clients, particularly divorcees. He distinguishes cash flow from a budget and outlines its three main benefits: providing peace of mind by showing clear income and expenses, being a reusable tool for various financial scenarios, and aiding divorcees in accurately filling out the Case Information Statement.

A common question I often hear from clients considering purchasing a rental property or who may have just inherited one through the passing of a family member or divorce is whether they should manage the property themselves or hire a professional management company.

The decision between a Roth 401(k) and a Pre-tax 401(k) can significantly impact your financial future. While both accounts offer unique advantages, certain scenarios may make a Roth 401(k) a more attractive option. This article delves into the top five reasons you might consider a Roth 401(k) over its Pre-tax counterpart.

Reed Fraasa, a wealth advisor and founder at Highland Financial Advisors, discusses the evolving landscape of financial services where professionals are increasingly shifting towards independent advisory roles. He emphasizes the importance of understanding a firm's purpose, uniqueness, and process when seeking a financial advisor. Fraasa advocates for a fiduciary approach, personalized wealth management for accredited investors, and a collaborative team structure. He encourages prospective clients to utilize a list of questions provided by the Certified Financial Planner Board of Standards to ensure they find the right advisor to put their interests first.

In this video, AnnaMarie Mock, a Certified Financial Planner™, focuses on the second step in her series for pharmaceutical executives, emphasizing the importance of cash compensation in financial planning. She compares compensation to a banana split, with cash compensation as the essential component. Mock advises managing lifestyle expenses based on a stable salary rather than variable bonuses and highlights the need for a spending plan.

In contrast to the first half of 2023, the second half has had volatile, lackluster returns for some of the stock market and pharmaceutical stocks. Market fluctuations can significantly impact wealth creation, especially when navigating stock compensation.

A Roth conversion is a financial maneuver where you convert funds from a traditional Individual Retirement Account (IRA) or 401(k) into a Roth IRA. This process involves paying taxes on the converted amount, as traditional IRA/401(k) contributions are typically made with pre-tax dollars, and Roth IRA contributions are made with after-tax dollars.

In talking with clients about the benefits their employer provides during the open enrollment season, one often overlooked benefit if clients have dependents is the Dependent Care Flexible Spending Account (FSA).

As the year draws to a close, it's the perfect time to look at your finances and implement year-end tax planning strategies. With careful planning, you can optimize your tax situation, reduce your tax liability, and save more money for the future. In this article, we'll explore various tax planning strategies that individuals and families can consider to maximize their financial situation before the year-end.

I recently read an interesting article in the Wall Street Journal about how anyone with a low-rate mortgage may not realize the actual value of their asset. In the current world of 7%-8% mortgage rates, anybody with a sub-4% mortgage rate owns a precious asset. Viewing a loan that needs to be repaid as an asset is counterintuitive. But any loan from a bank at 3.5% when rates on Treasury Bills and CDs are at 5% has significant value. By the Journal author's estimate, some $1 trillion in value has passed from banks and bondholders to homeowners.

Some investors have asked if stocks make sense in a world where short-term US Treasuries yield north of 5.5%. 1 While a notable relationship exists between high short-term interest rates and stock market returns, it's important to understand that correlation does not imply causation. Here's a breakdown of the dynamics:

Financial markets are complex and unpredictable. Valuation metrics, such as price-to-earnings (P/E) ratios, enterprise value-to-EBITDA, and the price-to-book (P/B) ratio, have traditionally been seen as indicators of a stock's intrinsic worth and, by some, predictors of future returns. However, the belief that valuations can reliably forecast future markets deserves a deeper investigation into why they may not serve as a crystal ball for investors.

A Restricted Stock Unit (RSU) is a form of compensation that some companies use to reward their employees. RSUs represent a promise to give an employee a certain number of shares of company stock at a future date, typically once certain conditions are met, such as a specified vesting period or performance goals. RSUs are a common form of equity-based compensation used in publicly traded and private companies.

If you are a reader of the Wall Street Journal, you may have seen three articles in the past nine months that addressed the issue of a significant shortage of accountants. According to the most recent data from the American Institute of Certified Public Accountants, the number of US students graduating with either a bachelor’s or master’s degree in accounting dropped 7.4% during the 2021–22 academic year from the year before, the largest one-year decline since at least 1994–95.

Is there a divorce season?

According to a study by associate sociology professor Julie Brines and doctoral candidate Brian Serafini of the University of Washington, the answer is yes, and they boiled it down into a simple formula...

Student loan payments resumed on October 1st after over three years of forbearance. More than 30 million people are returning with existing loans, and 13 million new borrowers and recent graduates are entering the system for the first time since the Covid-related forbearance. Regardless of whether everything is appropriately structured for the first federal loan payment, you should still review your student loans to ensure everything is in order and understand your new payment.

Representative Lauren Underwood from Illinois and Senator Tammy Baldwin of Wisconsin have reintroduced the Women's Retirement Protection Act of 2023. This critical legislation protects women's retirement savings after a divorce.

Health Savings Accounts (HSAs) are not only a savvy investment option but also offer numerous benefits, especially for high-net-worth families. An HSA is a tax-advantaged savings account designed for individuals with high-deductible health plans (HDHPs) to help cover out-of-pocket medical expenses. While the utility of HSAs is universal, they hold advantages for high-net-worth families and have steadily grown in popularity since their inception.

Earlier this year, I explained two principles you can follow to obtain the most happiness from your spending https://www.highlandplanning.com/learning-center-1/how-money-can-buy-happiness-part-1. In today’s article, I will cover three more concepts that can help bring more joy in your life with your spending. Below are the five principles outlined in the book Happy Money.

We only have 24 hours daily to do all life's necessities like work, sleep, and personal care. According to a 2022 US Bureau of Labor Statistics (BLS) survey, an average day has about 5 hours of leisure time. I'm unsure what the BLS counts towards 'leisure,' but I think it may be overstated. Nonetheless, the takeaway is our time is limited.

The S&P 500 index rose 16.9% on a total return basis over the first half of of 2023. If you factor in July, the index is up over 20%. After a challenging year for investors in 2022, when the index lost almost 20%, it’s hard to complain about this year’s progress. With the S&P nearly doubling the long-term average annual return in 2023, it’s easy to say the market is healthy and all companies are doing well, right?

Ever since I was a teenager and first watched the movie The Hustler, I’ve been hooked on shooting pool. I loved watching the two main characters, Fast Eddie Felson, played by Paul Newman, and Minnesota Fats, played by Jackie Gleason, battle it out on the pool table.

The "Tax Cuts and Jobs Act" (TCJA) of 2017 brought a significant shift in the taxation landscape for individuals and businesses. One of the changes was the $10,000 cap on deductions for state and local taxes (SALT). This limit impacted the tax strategy of many high-tax states, pushing them to find ways to mitigate the impact of this cap on their taxpayers.

Are you looking forward to some fun in the sun this summer? If so, you may already be planning for inconveniences such as travel delays, flight cancellations, and poor weather. Still, you may also want to consider how to prepare for a potential medical emergency.

One of the most fundamental principles of investing is diversification. Diversification does not overload your portfolio into any investment but instead spreads the risk across different areas. Ideally, your portfolio is invested in several diverse types of investments, but as you'll see below, there is more to diversification than buying stocks, bonds, or funds.

Tom Kean, former Governor of New Jersey, is known for saying in commercials. New Jersey and you, perfect together. When it comes to politics and your portfolio, they are imperfect together.

Deciding to accept, reject, or negotiate a job offer is very important and requires much forethought to assess all the components in the offer letter. Before diving headfirst, ensure your potential new employer matches not only your compensation expectations but also your values.

Everyone has heard the saying, “Money can’t buy happiness, but I’d rather cry in my Lamborghini.” Although I agree with the second part, money can buy happiness if spent correctly. I recently read a book called Happy Money which dives into the science of happier spending.

"The Three Questions Every Frantic Family Should Ask" is a book by Patrick Lencioni, a renowned author, speaker, and consultant on organizational health. The book aims to help families overcome the stress and anxiety of modern-day family life. Lencioni draws from his extensive experience in organizational health to provide practical insights and tools that families can use to build healthier relationships, communicate better, and achieve greater success in their personal and professional lives.

April 30th marked the 30th anniversary of the World Wide Web being introduced to the public for the first time. Tim Berners-Lee was a 37-year-old researcher at CERN, a physics lab in Switzerland when he created the first website and launched it on the Web as we know it today. 1.8 billion websites later, Lee's invention has revolutionized the way human beings interact and learn on a global scale.

Reviewing and adequately reacting when handed a severance package can be daunting. A flood of emotions and concerns can cloud your judgment and lead to rash decision-making. It's essential to pause and compose your thoughts before proceeding because some of your benefits will still be extremely valuable to your short and long-term plan.

According to the Department of Energy's SETO (Solar Energy Technologies Office), provisions included in the Inflation Reduction Act of 2022 will reduce the cost of installing rooftop solar by an average of $7,500, with taxpayers expected to realize an additional average savings of $9,000 on their electricity bills over the system's life.

Big houses, luxury cars, and expensive jewelry are some of the most common things people believe to be their greatest assets. Although all these things signify wealth, they do not come close to life's most significant wealth and asset, your health. Being physically and mentally able to do the things you love as you get older is something you can't put a price tag on.

Investing can be a daunting task, especially when you have a significant amount of cash to invest. One of the most crucial decisions is when to invest. Should you commit all at once or spread out your investments over time? This article will discuss the two primary investment strategies: lump-sum investing and dollar-cost averaging.

We have been getting a number of questions regarding Silicon Valley Bank and FDIC Insurance and thought it would be best to share a brief explainer video to shed light on how banks work, what happened to Silicon Valley Bank, and how you can maximize your FDIC insurance.

The Secure Act 2.0 has created several new planning opportunities. One provision that will appeal to those inclined to charitable giving is the ability to direct a qualified charitable distribution from an IRA toward funding a charitable gift annuity.

Pandemic investments and the continuation of gene therapy spurred the growth of companies in recent years. Still, these same companies are feeling the pinch due to growing economic uncertainty. Life sciences do better than other industries during economic and market drawdowns, but it is not immune to global influences.

Revelations around the collapse and government takeover of Silicon Valley Bank (SVB) dominated the news over the weekend. Except for the distractions provided by March Madness brackets and the Oscars, the word of failing financial institutions brought back bad feelings for everyone. Ironically, the film Everything Everywhere All at Once not only swept the Oscars but aptly describes the swiftness in which SVB collapsed.

I often asked this question in high school – it usually involved someone walking away without me finding out.

And now that I have your attention…

In September 2008, the financial services company ING launched a marketing campaign called “Your Number”. You may remember these commercials – they showed busy people going about their day with large six or seven-figure numbers floating over their heads.

Theodore Roosevelt once said, “Nothing in the world is worth having or doing unless it means effort, pain, and difficulty.” Many things that come quickly and easily do not provide the same value or worth as things we must work toward.

The Super Bowl Indicator is a market phenomenon first introduced in 1978 by New York Times sportswriter Leonard Koppett. His findings revealed that the outcome of the US stock market (measured by the S&P 500 or Dow Jones Industrial Average) could be predicted by the winner of the Super Bowl in the National Football League

When New Jersey deregulated its electric and gas industries in the late 1990s, it was supposed to bring a new competitive environment that would benefit consumers. By being a “shopping state,” New Jersey joined many other states in the northeast where consumers could shop for the best electricity or gas rates among competing third-party suppliers.

Pharmaceutical companies can have robust benefits packages encompassing cash compensation, equity compensation, and non-monetary benefits. It's essential to understand the type, timing, and amount of each to have a clear picture of your finances, as this provides the capital to grow wealth.

As we head into the new year, when it comes to financial markets, some people may expect more of the same as in 2022—essentially overweighting recent events compared to historical events. This is a behavioral issue known as recency bias and may cause people to make bad decisions with their money.

Depending on the list, sometimes being ranked #1 is where you want to be, and sometimes it’s not.

For example, New Jersey ranks #1 in education according to U.S. News and World Report. The Garden State also ranked #1 as the 2021 best state to live in (barely getting beat out by Massachusetts in 2022, boo!), #1 in most Revolutionary War battles in a single state, and #1 in the number of dentists per 100,000 residents.

The first investment speculative bubble was the tulip bubble of the mid-1600s. The details are debatable, but from 1634 to 1637, a speculative bubble developed on future contracts for new tulip varieties in Holland. Prices snowballed, reaching ten times the annual salary of a typical tradesman of the day. By February 1637, the market had collapsed. The tulip mania of the 1600s resulted from a mass hysteria for new varieties of tulips developed in Holland after the flower had been introduced to Europe only a few decades before.

A few years ago, I remembered having a conversation with a divorced client that stuck with me. The client struggled to decide whether to keep or sell the marital home after her finalized divorce. Although she asked the right questions and thoroughly understood the numbers, I could tell emotions guided her decision-making, not logic.

My friends often joke that I was looking forward to retirement from when I started working in 1979. With my initial IRA deposit of $1,500 in 1980, I was on my way.

During my sabbatical, I read a book by Simon Sinek, “The Infinite Game,” which was published in 2019 and inspired by James Carse’s 1986 book on game theory titled “Finite and Infinite Games.”

In the books, finite and infinite games are described in this way:

A finite game is played to win, like baseball or golf. The players are known, the rules are set, and the endpoint is defined.

Inflation is all everyone has been talking about for two years. Inflation reaching 40-year highs has wreaked havoc on consumers' wallets and caused market uncertainty.

The inflation story in 2021 was propelled forward by supply chain disruptions following the shutdown of the economy due to the COVID stay-at-home orders. This broad statement of supply chain disruptions expands to the physical transportation of products and a shortage of workers and materials

Investors face many risks. Sequence-of-returns risk has not been discussed much over the last decade. Sequence risk is the risk of an investor experiencing a down market while simultaneously needing to begin withdrawals from your portfolio.

Understandably, sequence risk has not been top-of-mind for many retirees due to the 12-year bull market that began in 2009 and just recently ended. However, the current bear market and high inflation have underscored the importance of understanding sequence risk and finding ways to help mitigate it.

Would you believe it if someone told you that you could improve sleep, reduce stress and anxiety, and boost your mental well-being by reducing social media and news intake? About four months ago, I decided to conduct a self-experiment where I reduced the time spent on social media apps and watching news channels.

“Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you.” -The Psychology of Money, Morgan House.

I was having dinner with friends in December of 2018, and at the time, the markets were in the middle of a 20% drawdown. While we were out, one of my friends met an acquaintance of his who happened to be a Sales Representative for one of the large Wall Street brokers. I was happy to listen to his perspectives on the markets.

Shakespeare wrote ten dramas, each with a different story and cast of characters. However, his tragedies follow the same five-act formula: Exposition, Rising Action, Climax, Falling Action, and Resolution. Every play, movie, and television shows from Shakespeare's time to today follows the same five-act sequence. Our culture's art and entertainment reflect our innate expectations of the hero's rise, fall, and resolution. Likewise, our expectations for the economy and financial markets are no different.

U.S. college tuition costs have skyrocketed over the last few decades, leading to an unprecedented number of students needing to finance the burden through student loans. As of August 2022, student loan borrowers owed a collective nearly $1,750,000,000,000 in federal and private student loan debt, with the average borrower owing $28,950.

Leonardo DaVinci wisely said, "Study the science of art. Study the art of science. Realize that everything connects to everything else." Financial planning integrates art and science through a dynamic process. The art is subjective and experienced while exploring goals and aspirations and making decisions. The science is objective and visible in the tools to develop projections analysis.

My wife, Alyssa, and I have three beautiful daughters, Sydney, age 5, and Peyton and Avery, our 3-year-old twins. A “relaxing” escape would not be in the cards with our three girls. I often joked that this sabbatical might be more about surviving three kids under age five than it would be about “recharging.”

Our brain constantly monitors for signs of threats and triggers emotional responses to avoid them. The most primitive part of our brain controls the instinct to prevent hazards. This basic survival instinct attaches a high probability to any piece of data forecasting anything. Like the weather forecast, human beings expect predictability regarding the economy and the stock market. However, forecasting should not be considered a prediction.

On September 8th, HIGHLAND dedicated a Day of Service to Habitat for Humanity, contributing to constructing five new homes in the heart of Paterson, NJ. The whole team showed up at 7:45 AM, ready to make a difference in a small spot on the planet. Habitat for Humanity helps people to become homeowners by providing affordable, adequate housing. The concept of "partnership housing" was started in central Georgia in the early 1970s by farmer Clarence Jordan and Milliard and Linda Fuller and gained global recognition when President Jimmy Carter got involved in 1984. Today Habitat for Humanity operates in all 50 states and 70 countries.

As the well-known saying goes, nothing can be said to be certain except death and taxes. The idea of taxation can be traced back to 3000-2800 BC when the first known taxation system took place in Ancient Egypt. Since then, there have been many changes and additions to the tax laws, with one point remaining certain; no one wants to receive a large tax bill that they weren't expecting.

The average cost of divorce in the U.S. is almost $13,000, according to Nolo.com. For high-net-worth individuals, it could be many times this amount. Making things worse is that married couples tend to carry more than double the amount of debt than single people, based on a recent Experian study.

The first half of 2022 has been a disappointing year for every investor. At the close of Q2 2022, a 60/40 hypothetical portfolio comprised of the S&P 500 Index and Barclays US Aggregate Bond Index was down over 12%. What's been the driving force behind these investment returns, and what can we expect moving forward?

Walter Mischel, psychologist and professor at Stanford University conducted an experiment in the 1960s about delayed gratification and published his findings in 1972. In the study, a researcher explained to a child they could either have one marshmallow immediately or two marshmallows if they waited 15 minutes.

College planning is a common financial goal for many households. However, for newly independent women going through a divorce, paying particular attention to how the term “custodial” is used in the divorce agreement is essential since it can impact the calculation for college financial aid.

As of Friday, the 29th of July, except for the NASDAQ market, the US equity markets recovered somewhat from the bear market correction. A bear market is a loss of 20% from the previous high. In the first six months of 2022, the equity market had lost over 80% of what it gained in 2021 and entered a bear market correction.

Two weeks ago, the latest Consumer Price Index data (the index that measures inflation) had risen 1.3% in June, bringing headline inflation up to 9.1% and core inflation (excludes energy and food) up to 5.9% over the last 12 months. With increases this large, it’s not surprising to know this has been the most significant 12-month increase since November of 1981. With inflation on the rise, the war in Ukraine, and the stock market in bear territory (when stocks fall at least 20% off their highs), are we doomed for a recession?

I'm new to gardening as my interest in this hobby blossomed (pun intended) over the Covid lockdown. This spring, I was clearing out my garden in preparation for my new plants, and I spotted a patch of weeds that overtook about a quarter of usable soil within the garden confines.

With the first half of 2022 closing just a few days ago, the S&P 500 is down almost 20% year-to-date. That would rank as the worst first half of the year in over 50 years! While many tend to avoid looking at their investment account statements during times like this, market downturns present unique opportunities for investors

For many newly independent women, taxes are not necessarily at the top of their priority list when we start discussing their financial situation. Whether it is the loss of a spouse or just having gone through a divorce, making sure they and their children will be ok is the primary goal.

Following a significant life event, such as divorce or the loss of a spouse, people face a common question: How will being newly independent affect my family's lifestyle? During this financially delicate period, a decrease in household income, the ability to remain in the family home, and the long-term impact on a person's retirement plan are all top of mind.

Did you know that a percentage of your IRA distributions may not be subject to New Jersey state taxation? There are two possible exclusions for IRA distributions from New Jersey income taxes.

Growing up, my parents instilled two philosophies in me; to always live below my means and save for the future. Those simple words of wisdom resonated with me and unknowingly shaped my personal and professional life. Through my parents’ guidance, anytime I’d get a cash gift, I’d put some away in savings (i.e., my very secure piggy bank) and spend the rest on myself (i.e., probably on candy or something of the sort).

On Friday, May 20th, Avantis Investors, a provider of low-cost ETFs, celebrated the launch of three new Responsible ETFs by ringing the closing bell of the New York Stock Exchange (NYSE). In attendance at the closing bell to celebrate the launch was Ed Leach, a Partner and Wealth Advisor at HIGHLAND.

Every time the stock market experiences a correction (down >10%), we hear that familiar phrase, “It’s different this time.” Since 1950, there have been 39 corrections for the S&P 500, and they have all been the result of a different set of circumstances. There have been six years when long-term government bonds lost 5% or more during the same period, all with varying circumstances. Being different doesn’t mean that the market will not recover from a correction.

“The expert in anything was once a beginner.” This quote by Helen Hayes (an American actress who is one of 16 people to win an Emmy, Grammy, Oscar, and Tony Award) is an excellent reminder that when you take the first step to learn or try something new, you are making yourself vulnerable to the feeling of failure.

Congratulations! You received a well-deserved promotion but are unsure of what that means for your total compensation. There are three main types of compensation, and it's essential to understand the type, timing, and amount of each to have a clear picture of your financial plan.

In early April, the Wall Street Journal published an article titled "The Safe Investment That Will Soon Yield Almost 10%." Surprisingly, the investment they were talking about was U.S. Treasury Series I Bonds.

Beginning with the 2024/25 school year, the Department of Education plans on some significant changes to the Free Application for Federal Student Aid (FAFSA).

There seems to be a list of five things for anything you can think of to improve your odds of success. Pareto’s Principle (the 80/20 rule) states that 80% of the results will typically come from 20% of the cause. If a list of five things can truly make a difference in your life, that is an excellent return on your behavior.

For the first time since December 2018, the Federal Open Market Committee (FOMC) voted at its March meeting to raise the federal funds target rate range by ¼ percent to 0.25% - 0.50%. Following this initial increase, the median voting member expects seven more rate hikes in 2022 and an additional four hikes in 2023.

Risk is one of the most common and overused words when discussing investments. Every questionnaire or exercise you go through to evaluate how you should be invested is centered around the word risk.

There has been no shortage of volatility with global equity markets on a rollercoaster ride this year. A steep drop in prices scares investors and heightens our senses to pay attention to avoid making mistakes. However, this fear can lead to indecision or taking no action.

Since President Trump signed the SECURE Act into law in 2019, questions have swirled around how to interpret some of the Act's provisions. To reduce confusion, the IRS recently released Proposed Regulations, which attempt to clarify the more ambiguous parts of the law.

In 1977, a celebrity suffered a heart attack and passed away with an estate of about $10 million dollars. Of that $10 million, about 70% was wiped out from taxes and fees, resulting in a net estate of $3,000,000. So, whose estate was this, and how did they end up losing $7,000,000 of their assets?

SWIFT is the acronym for Society of Worldwide Interbank Financial Telecommunication, a global network for payments between banks. Over 11,000 banks across the world use the SWIFT system. The network allows countries and companies to move money across borders and operate globally.

Our prayers and thoughts are with the Ukrainian people who are suffering immeasurably at the hands of the Russian military today. To characterize this as "geopolitical risk" that will impact our portfolios seems insensitive. Millions of Ukrainian people woke up today with plans to go to school and work, meet up with friends, or start vacations, and instead have bombs falling on their cities as Russia commits to war on their land.

As we head into the throes of tax season, investors will be getting a slew of tax documents to report on their tax returns. Tax filing can be complicated even further by adding equity compensation into the equation because there can be (1) multiple tax reporting forms for one transaction, (2) different tax treatments based on the type of compensation (3) specific rules for varying strategies.

What better time than Valentine’s Day to discuss the finer points of managing money once two people decide to become a couple? Whether you are newlyweds or simply choosing to join forces financially with the love of your life, there are some essential issues couples will need to discuss.

During a recent financial review with a couple, we discussed inflation. The wife asked me, “So, what is cyclical inflation.” I used the term illustrating the difference between temporary, transitory inflation and built-in, cyclical inflation. It suddenly occurred to me that those are some fancy words. What do they mean in plain talk?

The new year has begun, and with it come changes to monthly benefits and costs for Social Security and Medicare. On the positive side, Social Security recipients will see a 5.9% cost-of-living increase in their benefits, the largest since Ronald Reagan was President. Unfortunately, due to various factors, Medicare is also experiencing the most significant increase in Part B and D premiums in the program’s history.

Admittedly the title of this article is 100% clickbait but hear me out for a moment. What is the one strategy that ensures you have pieces of your portfolio that are winners?

An incentive stock option (ISO) is a form of equity compensation where the employee has the right to buy shares of the company at a discounted price with special tax treatment. An ISO is a long-term incentive that replaces cash compensation and encourages employees to contribute to the company’s growth and development, hoping the options grow in value over time.

On behalf of everyone at HIGHLAND, we are proud of the recognition we received as one of the top-rated Wealth Management firms in New Jersey. Advisory HQ conducted an independent, objective review of firms in New Jersey and recognized 11 top firms.

Around this time of year, investors may notice a drop in value in their mutual fund positions due to the funds paying out their annual capital gains distributions. It is important to realize that when this payout occurs, it will cause a drop in the fund's value since the fund's share price is reduced by the capital gains distribution, making it appear that the fund lost value.

Recently there has been considerable debate about providing investors with less than $5 million opportunities to invest in private equity (PE). A prior SEC chairman said, “the requirement that allows only wealthy investors access to PE does not provide the same investment opportunities to smaller investors.”

You probably think I am talking about 2010 through 2020, right? Nope. In doing some research, I stumbled upon an article in the LA Times from December 28, 1999. The headline? "Decade's Hottest Stocks Reflect Hunger for Anything Tech"

Recently, we had a client report that a fraudster had stolen her identity. It seemed that someone may have obtained access to her email address and was creating havoc with her online accounts. We immediately told her to go to the Federal Trade Commission's (FTC) website, www.identitytheft.gov, to report the incident and follow some immediate steps to start dealing with the breach.

In Part 1 of F.I.R.E., we explored the meaning behind the movement and the different variations, while Part 2 of F.I.R.E. provided some context on common misconceptions. With that backdrop, we are going to outline how to quantify your definition of F.I.R.E.

The two worlds of financial services are not clearly labeled so that you would necessarily know from which world you are receiving services. If you seek the services of a doctor, you will know if that doctor is a dentist, an internist, an oral surgeon, or a neurosurgeon by the sign on the door. Unfortunately, the titles used in financial services are less indicative of any professional standard.

For many people going through a divorce, a common decision that needs to be made is whether to keep the marital home. At first glance, the person considering remaining in the home may feel like the monthly cost is lower than renting. However, divorcees need to complete a careful analysis to ensure all costs of homeownership are factored in.

As of July 30th, Amazon employs 1 million people in the United States. In other words, 1 in 169 workers are employed by Amazon and are only second to Walmart's 1.6 million employees.

The US Financial Crisis of 2008 serves as one of the most memorable and devastating financial downturns in history. Regardless of your age, financial status, or area of living, the crisis likely had some impact on your life at the time. While many remember the crash in the stock market and the ensuing global recession, it’s essential to examine the underlying aspects of the real estate market which led to the build-up.

When going through a divorce, many challenging topics need to be talked through before things become finalized. When it is time to discuss marital assets, particularly among those 50 and older, retirement assets or pension benefits tend to be at the top of the list since they often have the most significant balances.

Personal fitness and personal finance are two of the most critical focuses in your life. Both affect everyone in some way or another. Making progress in either area results in dramatic improvements in your life.

Arguably one of the most important documents a divorcing couple in New Jersey will complete is their Case Information Statement or CIS as it is commonly known. The CIS is a required form in New Jersey divorces, and its purpose is to paint an accurate picture of each party's financial situation.

In Part 1 of F.I.R.E., we explored the meaning behind the movement and the different variations. According to a survey conducted by T.D. Ameritrade and the Harris Poll, only 11% of 1,500 respondents, have heard of the movement, while 26% are not familiar with the term but know the concept.

With the recent popularity of long-term care insurance, it is not surprising that the demand for hybrid long-term care (LTC) policies are rising. The American Association for Long-Term Care Insurance (AALTCI) reported that in 2019 the industry sold 250,000 hybrid LTC policies. This figure represents more than five times the amount of stand-alone long-term care policies sold in the same period.

Anyone who has watched the Britney Spears conservatorship saga unfold in the news recently can appreciate how distressing it is when a person loses control of their financial life. Britney's situation highlights the importance of proper planning and the downside of having a court decide who is best to act as someone's caretaker.

As the world continues to evolve, it comes as no surprise that life expectancy in the United States has vastly increased over the last four decades and will most likely continue to rise as new technological advancements in health care continue to emerge. The U.S. Census Bureau recently conducted a report analyzing the change in life expectancy over the 100 years from 1960 to 2060.

Put your extinguishers back because it’s not that type of fire, although the concept is spreading like wildfire. F.I.R.E., Financial Independence Retire Early, is a movement that began based on the idea of minimalist living and extreme frugality to save for early retirement.

Old ways of tracking finances included using a pen and paper combined with envelopes to “bucket” different spending needs. Then came along Excel, where people began using spreadsheets to keep their budget and spending. Today, we have apps available on our phones with software to create the budget for you and even track each transaction on your credit card.

Gap years are no longer just for recent graduates but are now for seniors who may not have had the time to pursue their passions or try something new during their working years. For many retirees coming from a work-centric culture, retirement may feel like crossing the finish line, followed by winding down and boredom.

According to the CDC, approximately 61 million people, or 1-in-4 adults in the United States, live with a disability. 529 Able accounts were designed in 2014 to offer people with disabilities a way to save in a tax-efficient manner while also being used for various expenses.

Inflation is the erosion of purchasing power over time, resulting in buying fewer goods and services with the same dollars. We might not feel the impact of inflation from day to day or even on a year-to-year basis, but the effect on purchasing power is visible over a longer time horizon.

When it comes to investing and managing your finances, many people wouldn’t think that the skills and mindset needed for success would be similar to the skills and attitude necessary for success with martial arts. However, I have come to realize that investing and practicing Brazilian Jiu-Jitsu, a type of Mixed Martial Art (MMA), have much more in common than one would think. Both require similar skills and disciplines to be successful.

The recent release of the American Families Plan marks the third part of President Biden's Build Back Better Initiative. Several proposals make up this plan, but it is important to note that they are just proposals at this point and will have to make their way through Congress, where legislators will undoubtedly modify many of the provisions.

Will continuing to work after reaching your full retirement age and electing to receive social security benefits increase your future social security benefits? That depends on your history of earnings.

When we help clients with their cash flow at Highland Financial, we pay close attention to credit card debt for a reason. Spending on everyday purchases with a credit card to earn travel points or cashback is a great way to get rewarded for things you would typically be paying for anyway. However, the caveat is that a client must pay off their balances in full each month and keep their excess spending in check. Otherwise, any perk you receive from the credit card company will be quickly negated by paying exorbitant amounts of interest.

Financial elder abuse involves family members, caregivers, or professionals that illegally exploit an older individual for their monetary assets and property for their financial gain. It is estimated that elder financial abuse costs older Americans upwards of $36 billion. According to the National Council On Aging, 1 in 10 Americans aged 60+ have experienced some form of abuse, but only 1 in 14 cases are estimated to be reported to authorities.

For many people utilizing a Roth IRA to help save for retirement, they enjoy the benefits of tax-free growth and tax-free withdrawals after the age of 59 ½. An additional advantage of the Roth IRA, in contrast to a Traditional IRA, is that you are not required to take minimum withdrawals at age 72, enabling the account to continue to grow tax-free.

In 2019, HIGHLAND instituted the sabbatical benefit for each employee to take a month off and detach from work every seven years. I was due to take the first sabbatical in 2020, but due to COVID19, I postponed it to 2021. From February 20th to March 20th, I took a one-month sabbatical from work. My wife and I rented a place on the beach on the west coast of Florida.

With President Biden signing the American Rescue Plan legislation into law last week, here is a high-level look at some of the bill's main provisions. There are many nuances to each of the major points highlighted, and this article only scratches the surface. As always, it is wise to consult with your financial advisor and tax professional to determine what you qualify for depending on your specific situation.

An employee completes Form W-4 to direct their employer as to the amount to withhold for federal taxes. The W-4 can result in an over or underpayment of taxes for the year if not done correctly.

As world economies continue to grow and evolve, it is becoming increasingly evident that China is playing a larger role in that growth. Some projections have China's GDP reaching $64 trillion by 2030, up from $14 trillion in 2019. By almost any measure, the Chinese economy is experiencing expansion that will likely continue in the decade to come. Still, it also has unique headwinds that it will need to overcome as well.

Restricted Stock Units (RSUs) are a form of stock-based compensation that can potentially provide a windfall but may come with a sizable tax bill. RSUs have two important dates, the Grant Date and Vesting Date(s). The Grant Date is when you are awarded the RSUs. The Vesting Date(s) is when you are transferred ownership of the shares and recognize the market value as ordinary income on your tax return.

With the news this week of Elon Musk investing $1.5 billion into bitcoin, along with Mastercard and Bank of New York announcing they will be supporting cryptocurrency on their networks, digital currencies have been getting a lot of attention. For those new to the altcoin world, it helps to understand the basics.

Federal student loans are efficient forms of debt because the interest is tax-deductible, and the interest rates are relatively low compared to other forms of debt like credit cards. In addition, student loans are designed as an investment in yourself and provide the ability to earn more through your human capital in the future.

Recent market moves in stocks of companies such as GameStop, Bed Bath and Beyond, AMC, and others have prompted a lot of discussion around the practice of shorting stock or betting a stock’s price will fall rather than go up.

In the past, we have discussed the benefit of a Health Savings Account or HSA. As a refresher, HSAs are designed for an individual or family to save pre-tax money up to the annual limits for either short-term medical expenses or long-term retirement planning.

With the election results in Georgia, President Biden will have a majority in both the House and Senate. Half the country may be excited about this, and about half the country may be in a panic. As an investment advisory firm, we want you to understand the facts and make decisions in your best interest. Far too often, we see people make short-term decisions based on a perception of something rather than a prudent judgment based on facts.

With the start of the new year, those who have auto leases coming due will be contemplating which new set of wheels to drive off the lot. While enjoying a new vehicle is the fun part, knowing whether you got a good deal on your lease is often less so. However, just by arming yourself with some basic knowledge of how automobile leasing works, you can significantly improve your odds of not signing an unfavorable contract.

Medical open enrollment allows individuals to start, stop, or modify their health insurance during a specified time, which applies to employer-provided plans, Medicare, and plans through the marketplace, i.e., heatlhcare.gov. Open enrollment timeframes can vary between medical insurance types. For example, open enrollment for Medicare is October 15th to December 7th, while the national marketplace enrollment is typically from November 1st to December 15th. Open enrollment for employer-provided plans is determined by the company's plan year, but all employees should be notified in advance for the coming year.