By: Richard A. Anderson

Sector Investment Strategies

Sector investment strategies have been around for decades and the proliferation of exchange-traded funds, or ETFs, have made these investment strategies available to the masses at a relatively low cost.

The problem with sector investment strategies is that while businesses change with technological advancements, the traditional sector classification system has remained unchanged. Traditional sector classifications typically are backward-looking, grouping companies based on their historical characteristics.

Does Amazon Belong to the Retail or Technology Sector?

At first glance, the question of whether Amazon is a technology or retail company may seem pretty straight forward. Amazon started out as an online book store and has transformed into the largest online retailer in the world.

But digging deeper into Amazon’s business, you realize Amazon is also a big player in the technology space. Amazon produces electronics such as tablets, e-readers, smartphones, and portable speakers. In addition, Amazon has even expanded into cloud computing with Amazon Web Services.

So then, why is Amazon classified as a consumer discretionary company along with the likes of Home Depot, Walt Disney Company, and Comcast Corporation? The answer is an outdated classification system that has not evolved to keep up with changes in company business models.

Amazon is just one example. Visa is classified as a technology company. Walmart is classified as a consumer staples company.

Evolved Sector Approach

To solve this problem, BlackRock developed a classification system that uses forward-looking inputs to allow for a more representative view of sectors within the U.S. economy. This classification system, known as the evolved sector approach, allows companies to be classified within more than one sector and updates sector constituents more frequently to account for both current and future drivers of company growth.

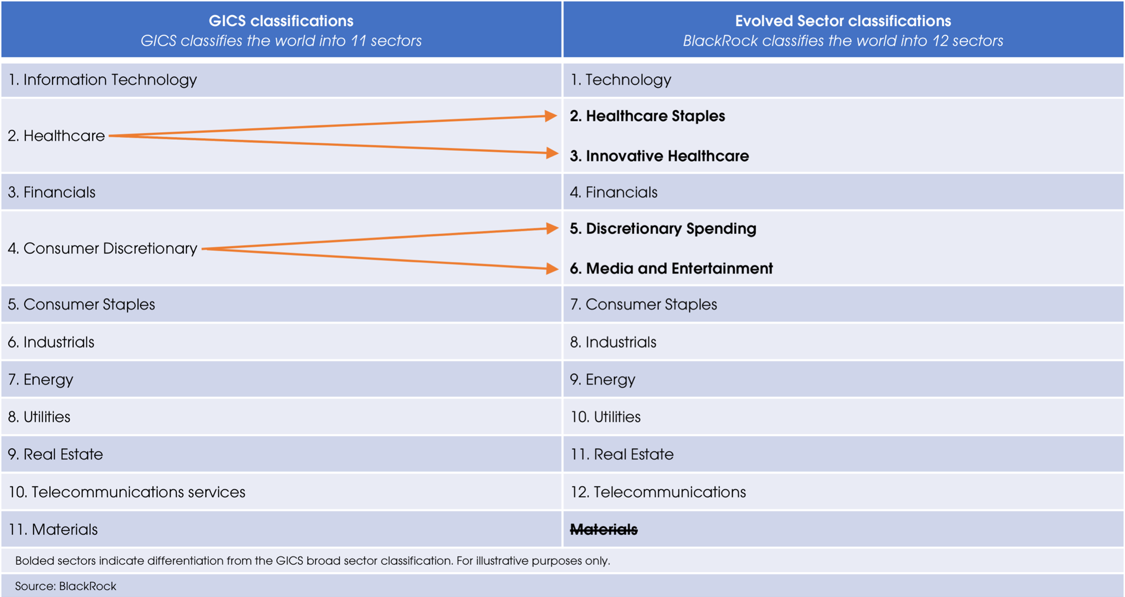

The chart below shows the most often referenced traditional sector classification system, the Global Industry Classification Standard (GICS), as compared to BlackRock’s evolved sector classifications.

The graphic below shows a sample of how companies classified as consumer discretionary under GICS are classified within the BlackRock evolved sector framework.

Highlands Investment Approach

At HIGHLAND, we invest your assets in diversified mutual funds that capture all sectors of the market. Our managers may have different weightings to sectors of the market as compared to an assigned benchmark index, but that difference is based on differences in expected returns of the underlying companies, not sector-specific expectations.

We don’t believe in investing in individual sectors of the market. Academic research and historical data has shown investors are not compensated for taking on the additional risk of investing in a more concentrated manner. Also, as demonstrated by the previous examples involving Amazon, Visa, and Walmart, the underlying holdings don’t always match the sector in which you believe you are investing.

Dimensional Funds Advisors

Our favored investment manager, Dimensional Fund Advisors, takes a different approach to portfolio construction than do traditional active managers or index funds. Dimensional looks at individual companies, not the sectors to which those companies are assigned.

This means they are indifferent to whether Amazon, or any company, is classified as a technology or consumer discretionary company. Rather, the primary focus is the company’s future expected return

With that said, we have been using an investment strategy that essentially ignores industry classification systems for years. We’re glad to see that BlackRock has brought this issue to the attention of the masses and brought a solution to those seeking to invest in companies in specific sectors of the market.

Learn more about Highland Financial Advisors’ Investment Approach, or schedule an appointment to speak with an advisor.