If your life has changed this year, it's worth reviewing your investment strategy to ensure it aligns with your current needs and goals. Markets shift, tax laws evolve, and your personal and financial situation may look very different from a year ago.

How to Adjust Your Investment Strategy for the New Year

The start of a new year is the ideal time to reassess your investment strategy. Much like reviewing your fitness goals or updating your household budget, your portfolio deserves a thoughtful check-up. Changes in tax laws, market conditions, and personal circumstances can all impact whether your investments remain aligned with your goals.

Is Your Portfolio Quietly Drifting Off Course?

Many investors begin the year with a carefully constructed portfolio that aligns with their goals and risk tolerance. However, as the year progresses, that portfolio may evolve into something different from what was initially intended. Markets move, sectors rotate, and performance varies across regions. Without realizing it, your portfolio may have “drifted”, leaving you with more risk than planned or less exposure to the areas that now offer opportunity.

Why Digital Infrastructure Could be the Bright Spot for America’s Economic Future

Beyond One Stock Wonders: Why Portfolio Diversification Matters

I’ve been asked numerous times throughout my career about the importance of diversification in a portfolio. After all, why not just buy the “hottest stocks” or the hottest sector, as evidenced most recently by the “Magnificent 7” (Google, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla)? This portfolio would have had a 1,3-, and 5-year annualized return of 20.9%, 46.22% and 37.98%, respectively.

The Mid-Year Reset: 5 Strategic Moves to Transform Your Financial Future

As we cross the halfway mark of 2025, the coming months present a crucial window for strategic financial decisions. While many focus on summer plans, forward-thinking investors are laying the groundwork for sustained growth. Here are five key investment areas we consistently address with HIGHLAND clients.

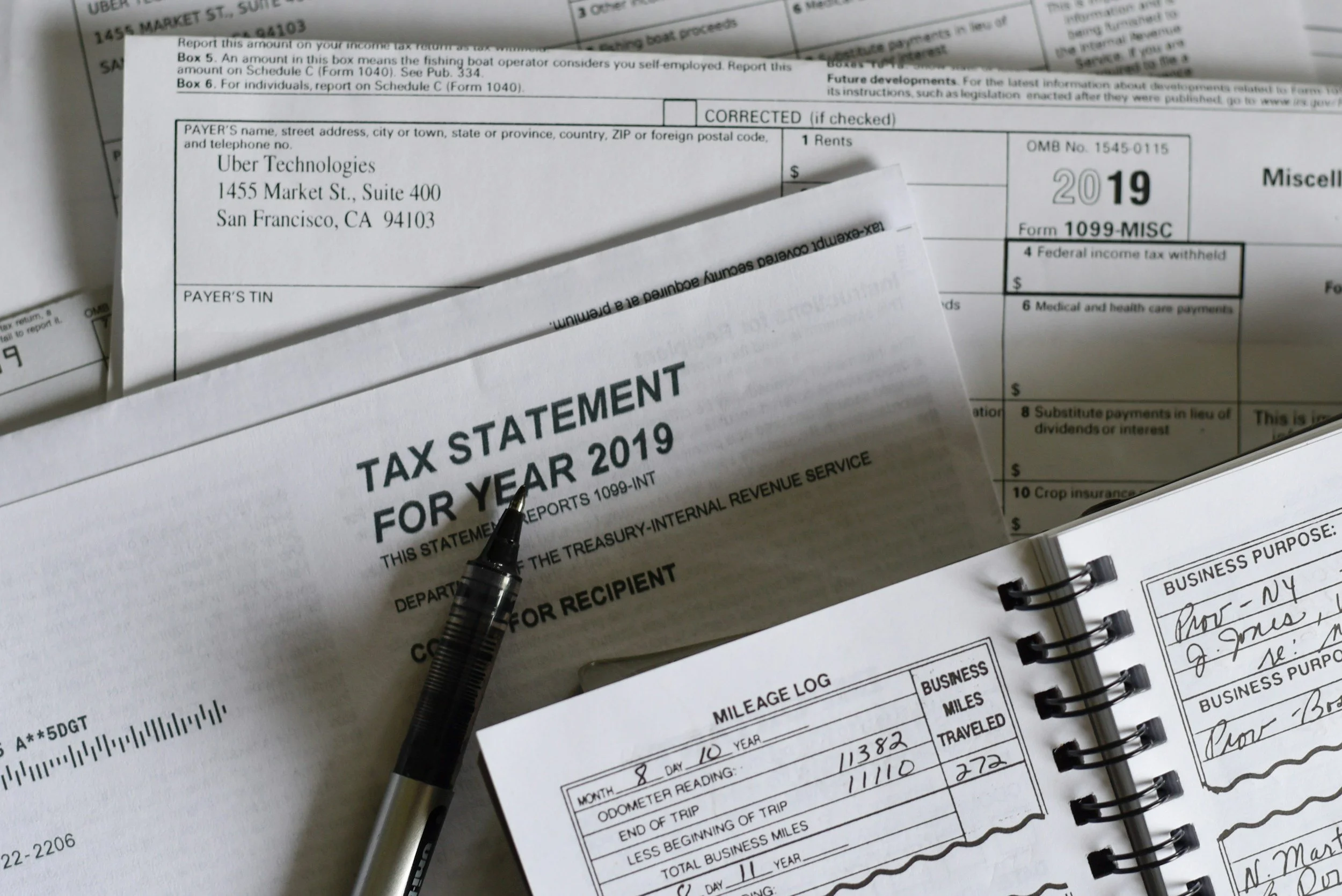

Keep More of What You Earn: 5 Tax-Efficient Investment Strategies

As a financial advisor, I often remind clients that investment returns are only part of the story—the after-tax returns are what truly matter. Without careful planning, taxes can erode your gains year after year. Fortunately, there are several strategies you can use to reduce your tax liability and grow your wealth more efficiently.

What Baking a Cake Can Teach Us About Building a Better Investment Portfolio

5 Ways to Ensure Your Investments Are Tax Efficient

For high-net-worth families, investing wisely is only part of the equation. Preserving wealth through tax efficiency is just as critical. Tax planning can dramatically affect long-term returns, especially when compounded over decades. Here are five strategies to help ensure your investments are working as hard after taxes as they are before.

Mid-Year Financial Check-In: Assessing Your Progress on Savings, Debt, and Investments

May is a great time to step back and take stock of your personal finances. The rhythm of tax season is behind you, and there's still plenty of time left in the year to make strategic adjustments. Whether working toward long-term goals or simply staying organized, a thoughtful financial check-in can help ensure you're on track and making the most of your resources.

What If We Planned for What Could Go Right?

The Long-Term Implications of Trump's Tariff War

Why Trump’s Liberation Day Tariffs Shook the Markets to Their Core

As fiduciary financial advisors, we strive to remain objective and apolitical in our advice. Political bias can lead investors to make poor decisions, and our role is to offer clear guidance grounded in facts. With that in mind, we offer a measured explanation of the market’s response to President Trump’s newly implemented tariffs.

Tariffs and the Economy: A High-Stakes Gamble with Global Consequences

Tariffs have long been a tool used by governments to influence international trade and protect domestic industries. While they might seem like a topic best left to economists and policymakers, tariffs can have real-world economic and market implications. Understanding how tariffs work and how they might affect our financial plans is essential for making informed financial decisions.

Two Strong Years, a Crash Ahead? Debunking Market Myths and Behavioral Biases

Tax Traps: The Hidden Costs of High-Yield Savings vs. Stock Market Gains

The current interest rate environment has driven many to explore high-yield money market accounts and certificates of deposit (CDs) as viable investment vehicles. With interest rates on these instruments at levels unseen in over a decade, it's easy to understand the appeal. However, there is an irony in using these vehicles as long-term investment strategies, especially when compared to the potential tax advantages the stock market offers.

My Biggest Investment Mistake

During my first year in college, I read my first investment book, "The Intelligent Investor" by Benjamin Graham, widely regarded as one of the greatest stock traders ever. Filled with excitement, I took copious notes, convinced I had stumbled upon the secret to success in the stock market. With this new knowledge, I eagerly deposited $600 into a trading account and made my first trade, purchasing ten shares of Columbia Sportswear Company stock ($COLM) at $56.80 per share.

Why Long-Term Investment Strategies Shouldn't Be Driven by Federal Reserve Interest Rate Decisions

As a financial advisor, I often hear clients express concern over the Federal Reserve's interest rate decisions and how these might impact their long-term investments. While it's natural to be attentive to such economic indicators, focusing solely on interest rate changes when planning your long-term investment strategy can be a misstep. Here’s why it’s important to maintain a broader perspective.

Is Your Stock Certificate the Next Big Thing?

Rummaging around your stuffed filing cabinet, you come across a stock certificate. A glint of excitement enters as you think about the potential value of this forgotten relic. It is not uncommon to stumble upon an old stock certificate in its physical form. There are steps to take to research if the old stock certificate is worthless or if it is a lottery ticket.