As a financial advisor, one of my most important recommendations to my clients is to review and update their beneficiary designations regularly. Life changes and your estate plan should evolve to reflect your current wishes and circumstances. Failing to update beneficiaries on retirement accounts, insurance policies, and wills can lead to unintended consequences, potentially leaving your loved ones in a difficult situation.

Tax Planning for the Self-Employed: Deductions You Shouldn't Miss

Key Tax Planning Considerations for 2025

Tariffs and the Economy: A High-Stakes Gamble with Global Consequences

Tariffs have long been a tool used by governments to influence international trade and protect domestic industries. While they might seem like a topic best left to economists and policymakers, tariffs can have real-world economic and market implications. Understanding how tariffs work and how they might affect our financial plans is essential for making informed financial decisions.

5 Spring Clean-Up Tips for Your Finances

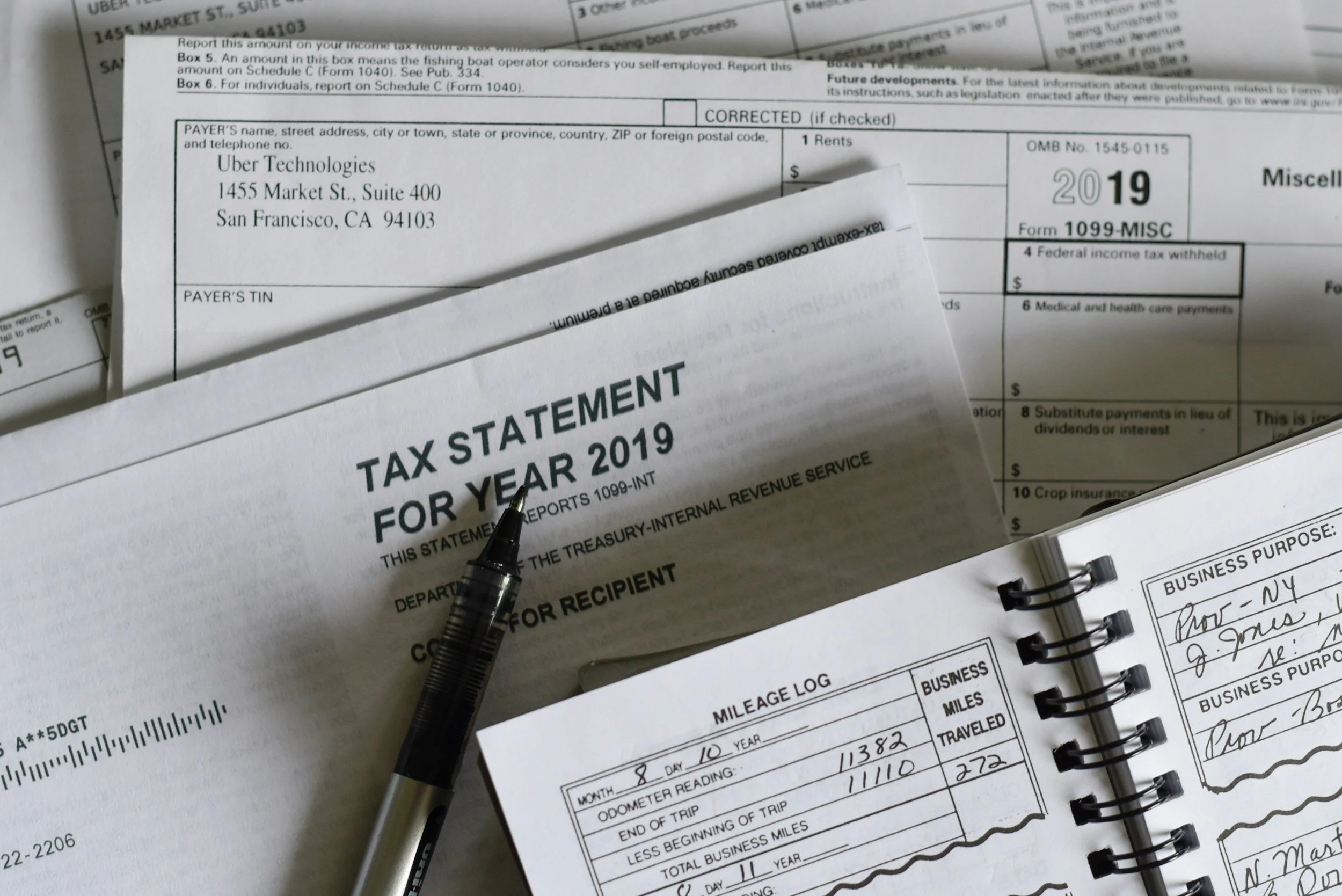

Understanding Your 1099s – Tax Reporting Tips for Investors

As tax season comes into full swing, many financial institutions have already begun sending out various tax forms to investors nationwide. For most, this is a stressful time due to the seemingly endless amount of paperwork to keep on top of. It can also be extra burdensome for investors with several moving pieces in their financial lives.

How to Understand and Maintain a High FICO Score: Tips for Better Credit Health

Your FICO score is critical in determining your financial opportunities, from securing a mortgage to getting the best interest rates on loans. A high FICO score can save you thousands of dollars over your lifetime, while a low score can limit your options and cost you more in interest. In this guide, we'll explain a FICO score, why it matters, and how to maintain a strong credit profile.

Why Maxing Out Your 401k is Not Always the Best Strategy

The conventional wisdom in personal finance often suggests maximizing your 401(k) contributions each year. While this advice can be sound for many people, financial planning isn't one-size-fits-all. Just like you wouldn't follow your neighbor's exact grocery list or copy their summer vacation plans (unless it was an epic trip), your retirement strategy needs to be tailored to your specific situation.

Mastering Tax Season: How to Organize Your Documents for a Stress-Free Filing

Tax season is approaching, and this time of year can feel overwhelming for many individuals and business owners. The key to a stress-free tax filing experience is organization. By proactively gathering and structuring your financial documents, you can maximize deductions, avoid errors, and ensure a smoother process when working with your tax preparer or filing independently.

Ed Leach Joins Passaic County Habitat for Humanity Board of Directors

Ed Leach, Partner and Wealth Advisor, is joining the Board of Directors for Passaic County Habitat for Humanity starting this January. By stepping into this volunteer leadership role, Ed will contribute his personal time and energy to advancing Passaic County Habitat’s mission of building homes, communities, and hope.

Essential Business Succession Planning for Dental Practice Owners: Protecting Your Legacy

Money Flowing Out? Your January Financial Reset Starts Now

As we embark on a new year, there's no better time to take control of your financial future by thoroughly reviewing your cash flow. If having a vision and establishing goals is the touchstone for a financial plan, this essential financial practice sets the foundation for achieving your goals and ensuring long-term financial stability.