Tackling debt can feel like climbing a mountain, but with the right strategy, you can reach the debt-free summit faster than you might think. Whether dealing with credit cards, student loans, or other forms of debt, implementing a structured approach can save you thousands in interest and free you from financial burden sooner.

Why Trump’s Liberation Day Tariffs Shook the Markets to Their Core

As fiduciary financial advisors, we strive to remain objective and apolitical in our advice. Political bias can lead investors to make poor decisions, and our role is to offer clear guidance grounded in facts. With that in mind, we offer a measured explanation of the market’s response to President Trump’s newly implemented tariffs.

Avoid Costly Mistakes: Why Updating Your Beneficiaries is Critical for Your Estate Plan

As a financial advisor, one of my most important recommendations to my clients is to review and update their beneficiary designations regularly. Life changes and your estate plan should evolve to reflect your current wishes and circumstances. Failing to update beneficiaries on retirement accounts, insurance policies, and wills can lead to unintended consequences, potentially leaving your loved ones in a difficult situation.

Tax Planning for the Self-Employed: Deductions You Shouldn't Miss

Key Tax Planning Considerations for 2025

Tariffs and the Economy: A High-Stakes Gamble with Global Consequences

Tariffs have long been a tool used by governments to influence international trade and protect domestic industries. While they might seem like a topic best left to economists and policymakers, tariffs can have real-world economic and market implications. Understanding how tariffs work and how they might affect our financial plans is essential for making informed financial decisions.

5 Spring Clean-Up Tips for Your Finances

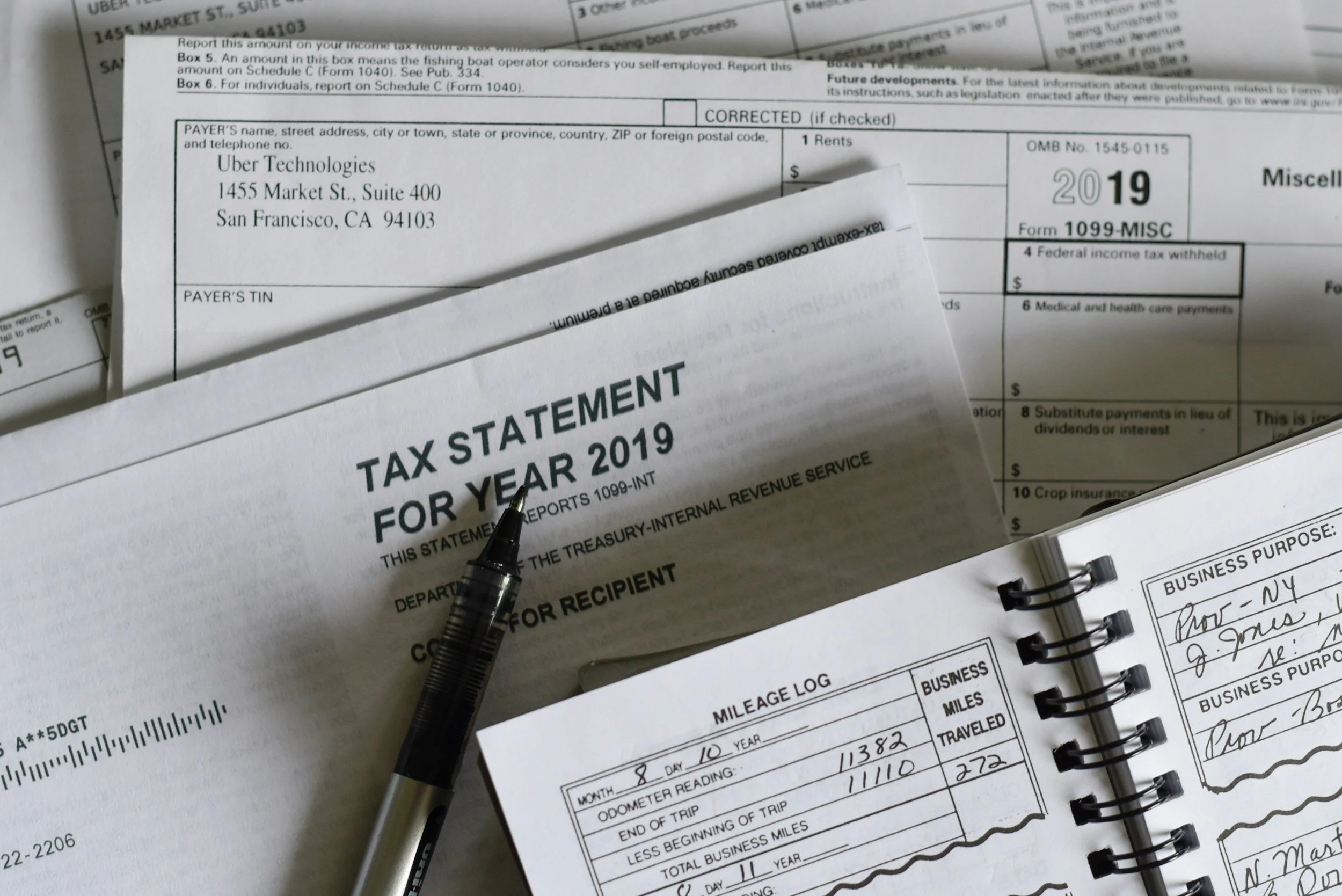

Understanding Your 1099s – Tax Reporting Tips for Investors

As tax season comes into full swing, many financial institutions have already begun sending out various tax forms to investors nationwide. For most, this is a stressful time due to the seemingly endless amount of paperwork to keep on top of. It can also be extra burdensome for investors with several moving pieces in their financial lives.

How to Understand and Maintain a High FICO Score: Tips for Better Credit Health

Your FICO score is critical in determining your financial opportunities, from securing a mortgage to getting the best interest rates on loans. A high FICO score can save you thousands of dollars over your lifetime, while a low score can limit your options and cost you more in interest. In this guide, we'll explain a FICO score, why it matters, and how to maintain a strong credit profile.

Why Maxing Out Your 401k is Not Always the Best Strategy

The conventional wisdom in personal finance often suggests maximizing your 401(k) contributions each year. While this advice can be sound for many people, financial planning isn't one-size-fits-all. Just like you wouldn't follow your neighbor's exact grocery list or copy their summer vacation plans (unless it was an epic trip), your retirement strategy needs to be tailored to your specific situation.

Mastering Tax Season: How to Organize Your Documents for a Stress-Free Filing

Tax season is approaching, and this time of year can feel overwhelming for many individuals and business owners. The key to a stress-free tax filing experience is organization. By proactively gathering and structuring your financial documents, you can maximize deductions, avoid errors, and ensure a smoother process when working with your tax preparer or filing independently.

Ed Leach Joins Passaic County Habitat for Humanity Board of Directors

Ed Leach, Partner and Wealth Advisor, is joining the Board of Directors for Passaic County Habitat for Humanity starting this January. By stepping into this volunteer leadership role, Ed will contribute his personal time and energy to advancing Passaic County Habitat’s mission of building homes, communities, and hope.

Essential Business Succession Planning for Dental Practice Owners: Protecting Your Legacy

Money Flowing Out? Your January Financial Reset Starts Now

As we embark on a new year, there's no better time to take control of your financial future by thoroughly reviewing your cash flow. If having a vision and establishing goals is the touchstone for a financial plan, this essential financial practice sets the foundation for achieving your goals and ensuring long-term financial stability.

Making Your Money Match Your Values: A Financial Planning Guide for the New Year

Two Strong Years, a Crash Ahead? Debunking Market Myths and Behavioral Biases

Holiday Debt Detox: The Ups and Downs of Credit Card Balance Transfers

The holiday season will soon pass, and for many, the joy of gift-giving has been overshadowed by a mounting credit card balance. As bills start rolling in, the temptation to explore a credit card balance transfer becomes increasingly attractive. But is this financial strategy a lifeline or a potential trap?

Holiday Spending Strategies

Ed Leach earns Certified Exit Planning Advisor (CEPA) Designation, Enhancing HIGHLAND's Personalized Wealth Management Services for Business Owners

HIGHLAND Financial Advisors is excited to share that Edward Leach, CFP®, MBA, has earned the Certified Exit Planning Advisor (CEPA) designation through the Exit Planning Institute (EPI). This education and experience strengthen HIGHLAND's ability to provide personalized wealth management to business owners as they navigate the complex planning process for their businesses' eventual transition.

Fee-Only vs. Fee-Based Financial Advisors: Understanding the Differences and Choosing the Right Advisor for You

Choosing the right financial advisor is one of the most important decisions you'll make for your financial future. But with so many types of advisors and compensation structures, it can be challenging to know where to start. In this video, Reed Fraasa, a Certified Financial Planner® and founder of Highland Financial Advisors, breaks down the key differences between "fee-only" and "fee-based" financial advisors.