By: Chris Fuksman, CFP®

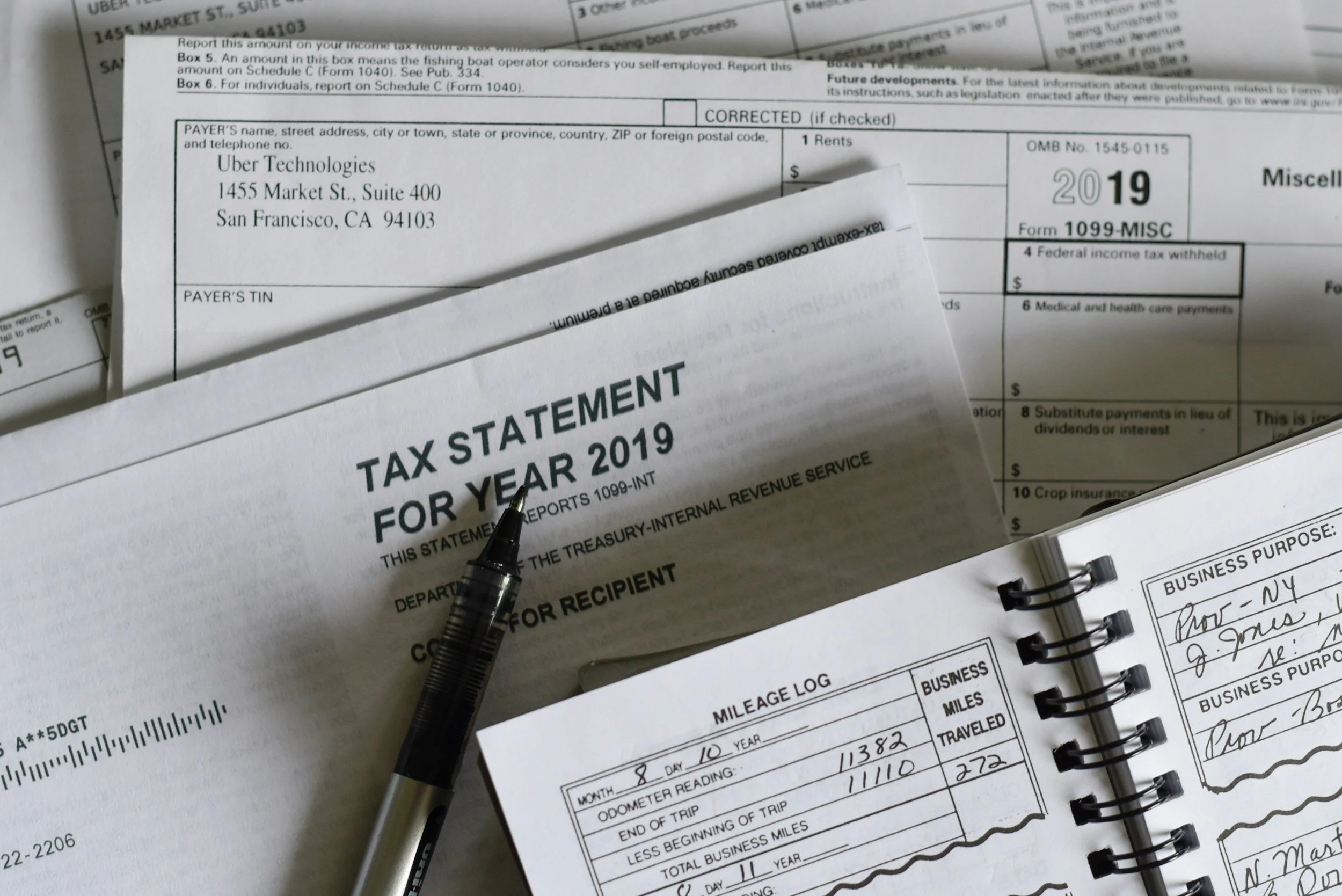

As tax season comes into full swing, many financial institutions have already begun sending out various tax forms to investors nationwide. For most, this is a stressful time due to the seemingly endless amount of paperwork to keep on top of. It can also be extra burdensome for investors with several moving pieces in their financial lives. This article aims to break down common tax forms the average investor might receive and their potential tax impact.

The 1099

One of the most widespread tax forms is the 1099. A 1099 is a group of tax documents that reports various types of income. Financial institutions use 1099s to report this unearned income to the IRS, similar to how an employer reports earned wage income via a W2. Some of the most common 1099s include:

1099-DIV – dividend income

1099-INT – interest income

1099-B – capital gain income

1099-R – retirement account distributions

1099-DIV – Dividend Income

A dividend is a distribution made by a company from profits it may have had throughout the year. While not guaranteed, many large and mature companies with strong cash flows and stable earnings may return portions of their profit to shareholders. Shareholders have several options when receiving dividends, each with their ramifications. Examples of dividend options include taking cash or purchasing additional shares of company stock. Regardless of the option chosen, dividend income earned is a taxable event and must be reported on your tax return.

The tax due on the dividend income also depends on the classification of the dividend. Dividends can either be qualified or nonqualified. A qualified dividend meets various IRS requirements, such as being paid by a domestic company or holding the dividend-paying stock for a specific time before the company's dividend announcement (ex-dividend date). Qualified dividends also receive preferential treatment and are taxed at a potentially lower long-term capital gains rate (0%, 15%, 20%). A nonqualified dividend does not meet the IRS criteria to be considered qualified and, as a result, is taxed at an investor's ordinary income tax rate (ranging from 10% to 37%).

1099-INT – Interest Income

Regardless of your status as an investor, if you have cash sitting in a checking or savings account, you are likely earning interest. It is important to note that most financial institutions will not send out 1099-INT to consumers who have earned less than a set dollar amount of interest in a calendar year (for example, $10). However, individuals must still report this interest on their tax returns.

Interest income can also be classified as taxable or tax-exempt. The classification depends on the interest payor, such as a corporation or government entity. Taxable interest is most common and is taxed at an individual's ordinary income tax rate. It might be paid by holding a savings account, Certificate of Deposit, or specific fixed-income instruments such as corporate bonds. Tax-exempt interest is also taxed at the ordinary income tax rate, but depending on the payor, it may be exempt from taxation at certain levels. For example, interest earned from a municipal bond will most likely be exempt from federal income taxes. Suppose the municipal bond is from a state government entity where the investor resides. In that case, the interest might also be exempt at the state level (a common investment strategy for investors in high-income tax brackets).

1099-B – Capital Gain Income

Capital gain is a common form of investment income that comes in several forms depending on the investment's holding period and underlying classification. The holding period on assets sold one year or less from their original purchase date is classified as short-term. The holding period on assets sold over a year from their original purchase date is classified as long-term. Assets sold with a short-term gain are taxed at the ordinary income tax rate. Assets sold with a long-term gain are taxed at the preferential long-term capital gains rates. In the event of a loss, certain loss types can be used to offset gains realized elsewhere. This most commonly occurs in brokerage accounts, where investors use losses in particular securities to offset gains in others (a common strategy known as tax-loss harvesting). After short-term transactions and long-term transactions are combined, the net result is your capital gain income. If the resulting value is a capital loss, a capital loss deduction may be taken (subject to certain limits) against other income. Any additional loss taken may be "carried forward" to future years indefinitely at the federal level. However, some states, like New Jersey, do not allow for carry-forward losses.

Besides the holding period, the underlying asset type may impact its tax classification. For example, holding a mutual fund may generate a capital gain distribution resulting from trading done by the fund's portfolio manager. The holding period depends on the actions taken by the portfolio manager, and trading often occurs at the end of the year, so it is prudent to keep these in mind as the investor has no control over what might happen. For this reason, investors may opt for the more tax-efficient exchange-traded fund (ETF), which is less likely to result in capital gain distributions. In addition, investors holding a commodity-based security (such as a Gold ETF) may be taxed at a special 28% capital gains rate if sold at a gain.

1099-R – Retirement Account Distributions

The most common reason for receiving a 1099-R is taking a distribution from a retirement account, such as a Traditional IRA. Some retirement account holders may not receive a 1099-R if no reportable transactions occur during the year. In addition, the resulting tax treatment of income reported on a 1099-R ultimately depends on the actual activity that may have occurred within the account during the year. The form will break down all the taxable and non-taxable events that may have happened and whether the activity met the account's respective distribution requirements. For any taxable activity, the income distributed will be taxed at the ordinary income tax rate. Certain distributions might also be subject to additional penalties if specific requirements are not met.

Final 1099 Tips

For those individuals living complex financial lives, tax reporting might seem like an impossible mountain to climb each year. However, below are a few final tips to keep in mind this tax season if you find yourself at odds with the different forms and documents you might receive:

Keep track of activity throughout the year (where possible). Knowing what happened last year is a good starting point to understand what to expect this year.

Not all income reported will match personal record keeping. For any potential discrepancies, contact the financial institution immediately.

Organize 1099s and other tax documents in a safe place once received. Please note some financial institutions may issue a consolidated 1099. At times, financial institutions may also issue a corrected 1099.

When in doubt, don't be afraid to ask for help. We highly encourage you to consult and work with a tax professional if you are uncertain or have complex income situations.

Chris Fuksman is a CERTIFIED FINANCIAL PLANNER® at HIGHLAND Financial Advisors, a Fee-Only fiduciary wealth advisory firm that offers comprehensive financial planning, retirement planning, and investment management. Chris graduated from Providence College with a degree in Business Economics in 2019 and successfully passed the CFP® national exam in 2024. As a Senior Analyst at HIGHLAND Financial Advisors, Chris works on client trading and assists with financial planning research, preparation, and analysis. Chris enjoys volunteering at his local animal rescue, traveling, and watching European soccer in his free time.