By: Joey Casolaro, CFP®

What is a Recession?

The National Bureau of Economic Research (NBER), which is the committee that officially declares recessions, used to define a recession as a significant decline in general economic activity that consists of two consecutive quarters of a reduction in real GDP. However, because the economic activity plummeted so fast and so widely in 2020 from Covid-19, the NBER classified that brief timeframe (two months) as a recession and updated the definition to be – “a recession is a significant decline in economic activity that spreads across the economy and lasts more than a few months.”

What Causes a Recession?

Many different factors can cause a recession. However, the most common include an overheating economy (rising inflation and unemployment below its natural rate), asset bubbles (like we experienced in 2002 with the “dot-com” stock bubble and 2007-2009 with the housing bubble), and economic shocks (what we experienced in 2020 with the pandemic).

The Business Cycle

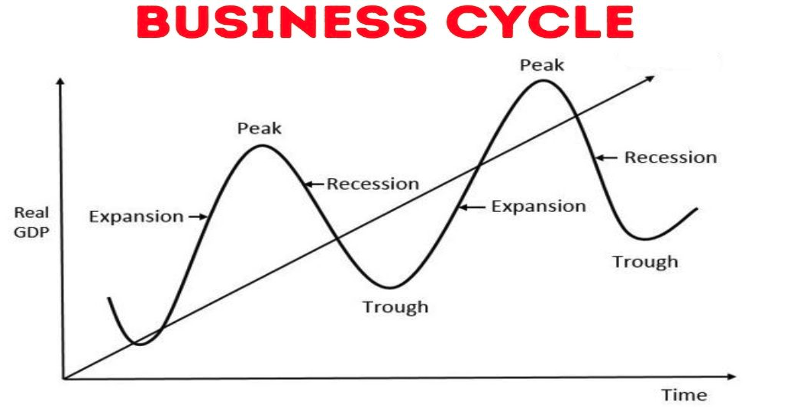

It’s important to note that the economy is cyclical and is continuously going through different stages of the business cycle. The graph below shows that the business cycle is measured by real GDP and time and consists of four phases: expansion, peak, contraction (recession), and trough.

We recently experienced all four of these phases within the past few years, starting with the expansion phase from 2009 to 2020 (the longest economic expansion in history). Then, the pandemic hit, and the business cycle went from expansion and the peak to contraction and a recession, which, although brief, eventually entered the trough phase.

Can a Recession Be Avoided?

Recessions have always been a part of the economy. Since 1926, there have been about 16 recessions in the United States which you can see in the chart below (recessions shaded in green).

The government and monetary authorities like the Federal Reserve System (the Fed) try to avoid recessions by controlling price stability (inflation) and maximum employment. However, as history shows, this is very difficult to do. One current example of how the Fed is trying to combat inflation is raising interest rates, making borrowing more expensive. When things are more costly to borrow, the demand for goods and services will begin to drop since people will start spending less, which will cause inflation to fall.

High inflation, a war, and a declining stock market all point to a possible recession. No one knows for sure when and if this will occur. However, we know we have been here before, and the economy and stock market have always recovered. As noted in the charts above, long-term investors have always been rewarded, and recessions are just another part of the business cycle. At HIGHLAND, it is our job to make sure you stick to your investment plan, especially when markets become volatile like we are experiencing now. Please contact your advisor if you have any concerns or want to discuss your portfolio and current needs.

The foregoing content reflects the opinions of Highland Financial Advisors, LLC, and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful or that markets will act as they have in the past.

Joey Casolaro is a CERTIFIED FINANCIAL PLANNER™ at HIGHLAND Financial Advisors, a Fee-Only fiduciary wealth advisory firm that offers comprehensive financial planning, retirement planning, and investment management. Joey graduated from the University of South Florida with a bachelor’s degree in personal finance and successfully passed the CFP national exam in 2021. Joey enjoys working out, spending time outdoors, and hanging out with family and friends in his free time.